The transatlantic partnership, through collective market power and regulatory influence, can stimulate reductions in metallurgical emissions.

For low-carbon steel to become a global industry standard, a comprehensive policy framework is needed to ensure predictability and market harmonization, according to Atlantic Tsuncil.

Industry on both sides of the Atlantic has already allocated significant resources to take advantage of this window of opportunity. However, these efforts have so far been made within a system that lacks standardization, methodology and trade policy support, which has led to the global steel market drowning in overcapacity, leakage, unintentional external environmental influences and unequal playing conditions for producers.

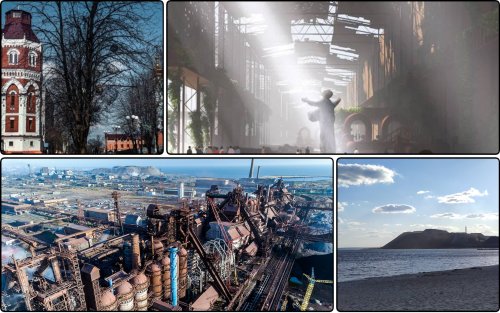

The metallurgical sector accounts for about 8% of global CO2 emissions, which should be reduced by 58% by 2050.

To harmonize world markets between trading partners, in October 2021 the EU and the US signed an agreement on steel and aluminum, which is an example of climate trade agreement between the two main trading partners. The agreement called for the suspension of the Trump administration's import duties on steel (25%) and aluminum (10%), as well as tariffs imposed by the EU and an application to the World Trade Organization. An EU-US technical working group has also been set up to share data and develop a common methodology for estimating embedded emissions in steel and aluminum.

The material noted that this agreement will also help implement the EU package " Fit for 55 "on reduction 55% of greenhouse gas emissions by 2030. One of the key provisions of the package strengthens emissions trading systems (ETS) to increase pressure on industries such as metallurgy. The EU is also trying to introduce a new carbon border management mechanism (CBAM) to tackle carbon leakage. The bloc expects that with a favorable regulatory framework and proper infrastructure, the metallurgical sector will be able to reduce CO 2 by 30% by 2030 and by 80-95% by 2050.

The US metallurgical industry produces relatively low-carbon steel compared to its European counterpart, largely due to the greater use of recycled scrap in production rather than direct efforts on climate policy. However, a combination of the Biden administration's recent passage of a bipartisan infrastructure bill and the FAIR law suggests that a policy to prevent the import of carbon-containing products is on the horizon.

At the federal level, Biden's federal initiative "Buy Clean" is still in its infancy. However, California's Buy Clean California Act (BCCA) allows for the calculation of global warming potential standards for building materials, including steel, and requires manufacturers to disclose environmental product declarations for certain materials in construction projects. Similar laws have been introduced in Washington, Oregon, Texas, Minnesota, New York and New Jersey.

Outside the immediate legislative arena, there are several groups proposing standards for low-carbon steel to help create a level playing field in the industry. In June 2021, the Minister for Clean Energy, coordinated by UNIDO, launched the Industrial Deep Decarbonization Initiative (IDDI), which aims to stimulate policy development by stimulating the low-carbon market. ResponsibleSteel, in partnership with the SteelZero Initiative Climate Group, has developed international standards that rely on a two-step certification process that compares the sum of baseline emissions and methane emissions with a homogeneous endpoint (crude steel).

The RMI has initiated the creation of a Climate-Based Finance Center, part of which focuses on metallurgy, and is involved in the Coalition of Emissions Transparency Coalition (COMET). This is a joint initiative to create a universal greenhouse gas calculation system for mineral supply and production chains.

The development of these methodologies in a relatively short period of time raises concerns that how and which methodologies will be adopted and implemented, who will certify product declarations and what the potential long-term and short-term consequences may be.

As standards for green steel continue to be developed and proposed, the effectiveness of any standard is likely to depend on its general recognition. Success will depend on whether it adheres to a widespread methodology for measuring built-in emissions and whether the calculations made by industry are familiar and accepted.

There are a number of priorities to consider before adopting a common standard:

- standards remain technology-neutral;

- supply chain emissions are taken into account;

- the standards took into account efforts to acquire renewable energy and further green the producer's supply chain and to purchase low-carbon energy.

- calculation metrics are well understood and recognized as scientifically sound.

Although setting standards for low-carbon steel nationally and internationally has become a top priority, there are growing concerns in the political world about transparency in the process, and in industries that set standards will lack the technical specificity and flexibility needed to produce.

As both sides of the Atlantic work to develop the green metallurgical industry by scaling up technology and improving climate policy, industry leaders are in favor of a coherent regulatory framework for the development of a green steel industry on equal terms. In order to solve the current unresolved problems of the green metallurgical industry and pave the way for the future decarbonization of other energy-intensive industries, it is necessary to establish borders, common methodology, scalable technological solutions and procurement standards.

We will remind, metallurgical company Voestalpine plans produce green steel in Austria.

As EcoPoliticа reported earlier, a way has been found in Australia decarbonize the steel industry.