The International Monetary Fund (IMF) insists that carbon taxation is the most effective tool for limiting fossil fuel use and associated CO2 emissions.

The tax can ensure the accumulation of funds for the green transition, reports Office of Sustainable Solutions.

The material explained that in order to implement the Paris climate agreement, the level of CO2 emissions into the atmosphere must be reduced by a third by 2030, and a fee of $70 per ton must be introduced.

So in In 2017, the countries of the world received approx $ 33 billion from the introduction of carbon policies, and in 2019 – $45 billion

"In 2019, the global CO2 market reached a value of $ 215 billion with an annual growth of 34% since 2018. The global growth of markets took place against the background of a decrease in trade volumes by 370 million tons. The European market is the largest in the world – €169 billion in 2019 with a growth of 30%," the authors noted.

They named the instruments used in the world to stimulate the reduction of CO2 emissions:

- tax (direct use in the budget, secondary use, environmental costs, taxation of fuel, emissions);

- market (emissions trading systems);

- regulation and subsidies (environmental standards, policy of supporting innovative sectors of the economy).

"However, the main mechanisms are the emissions trading system and the tax on CO2 emissions," they emphasized.

They said that the European Emissions Trading System (EU ETS) is based on EU Directive 2003/87/EC and has been operating on the cap-and-trade principle since 2005.

Such a system covers:

- energy (thermal power plants with a capacity of more than 20 MW, oil refineries and coke ovens);

- production and processing of ferrous metals;

- extractive industry (in particular, the production of cement, bricks, glass and ceramics);

- pulp and paper industry.

Revenues from the sale of CO2 emission permits within the EU ETS provide member states with revenues that can be used for decarbonization projects and the introduction of renewable energy sources. In addition, an emissions price raises the costs associated with polluting activities and encourages businesses to cut emissions where it is most financially beneficial to do so.

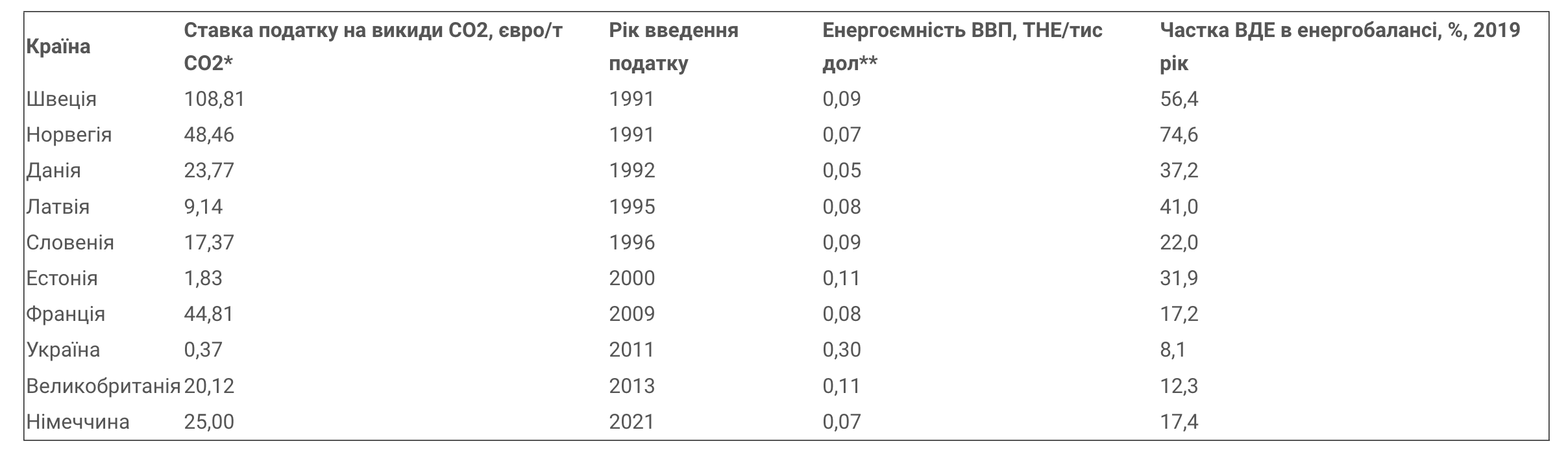

The authors noted that the carbon tax was first introduced in northern European countries in the early 1990s for greenhouse gas emissions from burning fossil fuels.

The article also talked about the experience of countries in stimulating the reduction of CO2 emissions.

Thus, Sweden became one of the first countries in the world to introduce a tax on CO2 emissions in 1991. In 2020, it reached €108.81 and was paid by households and businesses outside the EU ETS.

In the country, tax rates are expressed in general trade units (volume or weight). A tax on CO2 emissions is levied on all fossil fuels in proportion to their carbon content, as combustion emissions are proportional to the carbon content of the fuel. And the burning of sustainable biofuel does not lead to a net increase in carbon in the atmosphere and is not subject to CO2 emissions tax.

"The example of Sweden shows that it is possible to combine reduction of CO2 emissions and economic growth. This effect was noticeable already five years after the introduction of the tax and is still visible today. During 1990-2013, GDP increased by 61%, and CO2 emissions were reduced by 23%," the article says.

From 2021, Germany introduced a carbon tax at the level of €25 per ton of CO2 emissions. It is assumed that during 2021-2025 it will gradually increase to €55 per ton.

Such a tax is intended to stimulate the abandonment of the use of fossil fuels and the transition to RES. It raises the prices of gasoline, diesel, fuel oil and natural gas because of the CO2 content. All income from the CO2 tax should be used to reduce the cost of green electricity.

The article emphasized that the countries that were the first to introduce a tax on CO2 emissions have the largest shares of RES in the energy balance. After all, the tax funds were used to finance energy efficiency measures and spread the use of green technologies.

In Ukraine, the tax on CO2 emissions was introduced in 2011 and is a component of the environmental tax. However, until 2019, the tax rate was very low (from UAH 0.26 to UAH 0.41 per ton of CO2 emissions), which did not stimulate entrepreneurs to implement energy-efficient measures and switch to RES.

Since January 1, 2019, the tax rate has increased 24 times to UAH 10 per ton, and the amount of collected funds has increased 18 times to UAH 900 million. However, all funds were directed to the general fund of the state budget, with no intended use.

The authors emphasized that the peculiarity of the Ukrainian tax on CO2 emissions is that it is paid on the basis of completed declarations and is calculated at the time of emissions and has a complex calculation algorithm. Businesses that burn biomass are also subject to taxation, although it is considered a carbon-neutral fuel and is not taxed in the world. However, no changes to the legislation have been developed so far.

"Ukraine has an obligation to harmonize its legislation with the EU directive 2003/96/EC on the restructuring of electricity taxation and to transfer the basis of taxation of CO2 emissions to fossil fuels. This makes it possible to cover all potential CO2 emissions with a tax and to stimulate the transition to RES," the article emphasized.

In February 2021, acting Minister of Energy Yuriy Vitrenko announced his intention to promote the green energy transition by increasing the tax rates on CO2 emissions and directing the proceeds from this tax to the development of renewable energy in Ukraine.

"It will be fair: whoever pollutes the environment and negatively affects climate change pays. Those who make living conditions better, the environment cleaner, receive a certain compensation," Vitrenko said.

The material also noted that due to the introduction of the carbon tax (CBAM) in the EU, Ukraine's delay in raising CO2 tax rates with compensatory mechanisms (systems of financial support) may lead to the fact that Ukrainian products will become uncompetitive on the European and world markets.

As EcoPolitic reported before, in the global fight against climate change is important revision of world trade policy standards. The solution lies in increasing taxes on "dirty" goods and exempting them from tariffs on green goods.