In the global fight against climate change, it is important to review the standards of world trade policy. The solution lies in increasing taxes on "dirty" goods and exempting them from tariffs on green goods.

Сolumnist Hugo Dixon lays out 5 principles to help make trade policy fairer in reducing carbon emissions in the Reuters blog.

It is assumed that currently trade is one of the main causes of global warming, because goods are brought from far away on ships that pollute the environment. In addition, raw materials and components are supplied from all over the world. However, the right trade policy can solve these problems.

- Fair tariffs for carbon emissions

Taxing companies according to the amount of carbon emissions will go a long way in stopping climate change. This would encourage companies to reduce emissions and switch to cleaner technologies. Experts at the International Monetary Fund believe that a tax of $75 for every ton of carbon emissions by 2030 will help achieve climate goals.

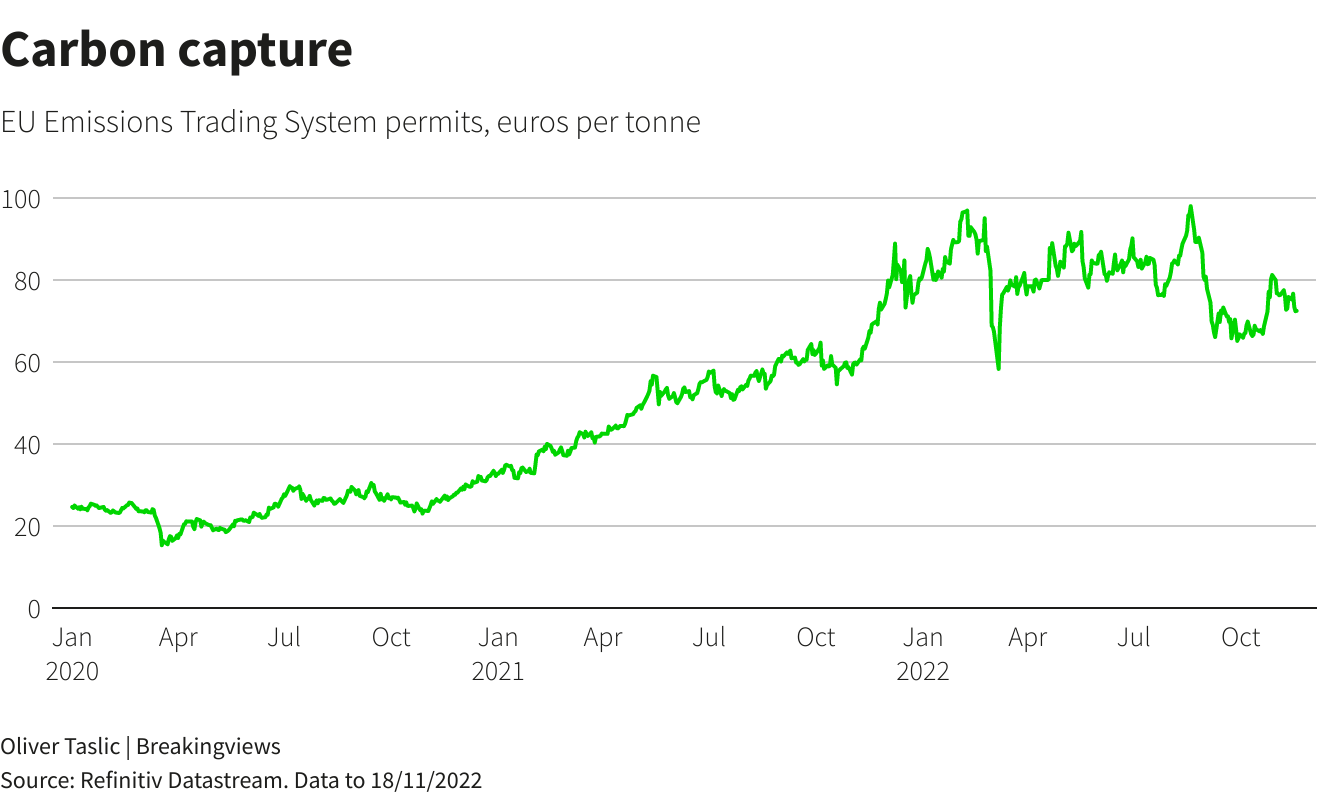

However, the average price of carbon emissions set by 46 countries is $6. Of the largest economies, only the EU and the UK set a price on carbon at or above $75 per tonne. The article emphasized that if these countries were to import cheaper and more carbon-intensive products from abroad – something called "carbon leakage" – the planet could still suffer.

In December 2022, the EU is expected to finalize plans for the Carbon Border Adjustment Mechanism (CBAM), which will introduce tariffs from 2026 on imports from countries that undertax their companies for carbon emissions.

The paper noted that CBAM could also push other countries to introduce their own higher carbon taxes and trigger trade disputes, particularly with the US, which do not plan to introduce carbon taxes.

- Fairer subsidies

The EU designed the CBAM in line with a key World Trade Organization (WTO) principle of non-discrimination, but there is no indication that the US has done the same with the Inflation Reduction Act (IRA). The EU and other countries are outraged that the IRA favors American manufacturers at the expense of foreign competitors. This splits trade, preventing industry from benefiting from global economies of scale. However, the EU hopes to resolve the dispute at the US-EU Trade and Technology Council meeting in December 2022.

- Reducing fossil fuel subsidies

In many countries, tariffs for fossil fuels are lower than for renewable energy sources. In addition to encouraging environmentally friendly technologies, the world can "punish" fossil fuel consumption.

According to the IMF, in 2020 total fossil fuel subsidies amounted to $5.9 trillion, or 6.8% of global GDP. A significant proportion of these are "implicit subsidies", where governments do not charge enough for the environmental damage caused by burning oil, gas and coal, or do not apply conventional taxes on consumption.

However, the Group of 20 major economies said they would step up efforts to phase out inefficient fossil fuel subsidies.

- Taxation of ships and aircraft;

According to the WTO, international trade accounts for 20-30% of total greenhouse gas emissions, including the production of goods and their delivery. The international transport sector accounts for 12% of global emissions.

The authors emphasized that taxing ship and aircraft emissions would lead to the end of long-distance delivery of goods, unless there is a compelling reason to do so. And it would also stimulate the development of "more environmentally friendly" fuel for transport.

- Promotion of green trade

"The easier it will be to transfer "clean" technologies, such as solar panels, around the world at low prices, the faster countries will be able to cope with climate change," the author of the blog believes.

Earlier, EcoPolitic wrote, that specialists of the PricewaterhouseCoopers (PwC) consulting and audit network called on importers from multinational corporations (MNC) prepare for the implementation of the carbon border adjustment mechanism (CBAM).

As EcoPolitic previously reported, specialists of the International Energy Agency (IEA) called for rapid transition from coal generation to alternative energy sources and developed accessible and fair guidelines for governments. After all, emissions from existing coal assets alone will push the world beyond the 1.5°C warming limit.