In most Asian countries, carbon prices and taxes are too low to have a significant impact on the fight against climate change and to force polluters to reduce emissions.

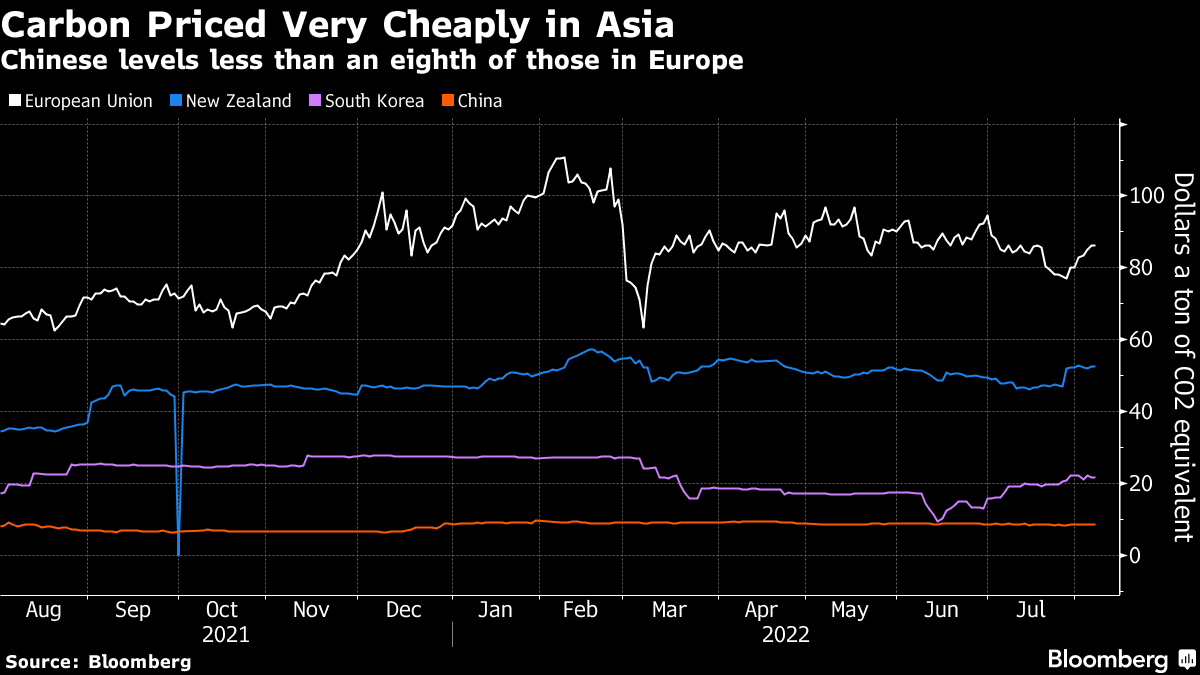

Carbon prices in China and South Korea are a fraction of those in the EU, while taxes in Japan and Singapore are set at very low levels, reports Bloomberg.

These markets, in their current state, will not be sufficient to change the behavior of polluting industries or help countries achieve their net zero goals.

The World Bank noted that Asia is struggling to adopt ambitious pollution pricing instruments, especially at a time of soaring inflation, rising energy prices and economic instability. Carbon pricing is one of the most powerful tools to put economies on low-emission paths, but price signals must be sustained, strengthened, and extended to a greater portion of global emissions.

Carbon markets in Asia are not tightly regulated, so they cannot send the right signals that will lead to emissions reductions.

"Markets will only function well once tighter limits are imposed on pollution levels, raising prices and creating urgency among companies to curb emissions and demand for credits," said Yeon Sejong, director of Plan 1.5, a Seoul-based climate advocacy group.

For example, carbon prices in China peaked at around $9 per ton in early 2022. Only New Zealand has prices close to $80 per ton of the most liquid carbon market.

According to the International Monetary Fund, about 46 countries in the world now set carbon prices through trading schemes or taxes, covering about a third of emissions. The current average price of $6 per ton of carbon dioxide equivalent must rise to $75 by 2030 to effectively limit global warming.

Overview of current progress in Asia

- China

China, the world’s largest emitter, launched its emissions trading scheme in the middle of last year. The initial focus is on more than 2,200 electricity generators that account for about 40% of the country’s emissions, with steel, cement, aluminum and petrochemical producers next in line to join.

Trading in what’s the world’s biggest market by emissions covered has been lackluster, however, and there have been delays in adding new industries as well as data collection problems. Beijing seems to be trying to strike a balance between its environmental and economic goals by prioritizing participation in the ETS over more stringent goals on reducing emissions, with energy shortages last year also spurring authorities to relax curbs on fossil fuels.

- South Korea

South Korea introduced a national ETS in 2015, and it has since expanded to cover 74% of domestic emissions across industries including power, transport, aviation, construction and waste management. The carbon price remains relatively low, at 28,000 won ($21.57) per ton of carbon dioxide equivalent, around a quarter of the level in Europe. Only 10% of allocated carbon credits will be auctioned between 2021 and 2025, meaning the rest will be given out to companies for free.

- New Zealand

New Zealand launched an ETS in 2008, with major reforms made to it last year. Those included a new cap on unit supply and the introduction of an auction mechanism. Auctions started in March 2021, with as many as 26.3 million allowances made available for this year. Agriculture, a major sector for emissions in the country, is still not covered, however. The nation’s carbon price is the highest in Asia, at NZ$83.32 ($52.39).

- Japan

Japan was the first Asian country to impose a national carbon tax, in 2012, but it’s set at just 289 yen ($2.17) per ton of CO2-equivalent. The environment ministry had requested the introduction of a much higher levy, but the government backed away from the proposal amid industry protests. Japan also has subnational emissions trading systems for Tokyo and Saitama prefectures.

- Singapore

Singapore introduced a carbon tax, set at S$5 ($3.62) per ton of CO2-equivalent, in 2019. It’s planning to raise it to $25 in 2024, and then lift it gradually to $50 to $80 by the end of the decade. The government also allows companies to use high-quality international carbon credits to offset up to 5% of their taxable emissions.

- Indonesia

Indonesia had planned to introduce a carbon tax of 30,000 rupiah ($2.01) per ton of CO2-equivalent on coal-fired power plants that generate about 70% of the country’s electricity from April. The levy was delayed, with a government official saying in June that was to protect the economy from rising fuel and food prices. Jakarta has pledged to go ahead with the tax before the end of the year and is also working on a proposal to price the cost of building out renewable power capacity to replace coal plants.

- Australia

Australia has the Emissions Reduction Fund, a voluntary system that involves the state buying carbon credit units through reverse auctions largely from sequestration projects. The Labor government, which came to power in May after a climate-focused election, sees enormous potential for carbon markets and has announced an independent review of the current system due to concerns over its integrity.

Andrew Macintosh, a former chairman of the country’s Emissions Reduction Assurance Committee, said in March that as many as 80% of carbon credits issued under the voluntary system didn’t offer genuine or additional abatement of greenhouse gas emissions. Australia previously had a national carbon pricing market, which started in 2012 but was abolished two years later.

- India

India, the world’s third-largest emitter, is planning a carbon trading market that would cover the energy, steel and cement industries, according to people with knowledge of the plan. It could be officially announced on Independence Day on Aug. 15, and a detailed plan is likely to be ready in the fourth quarter.

Elsewhere in Asia, Thailand, Vietnam, Malaysia and Pakistan have some form of carbon pricing planned or under consideration, according to the IMF.

Earlier, EcoPolitic wrote, that India plans to launch an emissions trading market carbon for the main sources of emissions in the energy, steel and cement industries.

As EcoPolitic previously reported, the MEPs agreed on new conditions for ETS and CBAM.