Steelmakers in Europe will have to rethink their decarbonization strategies due to rising natural gas and electricity prices.

Also, potential restrictions on the supply of natural gas may affect strategies, reports McKinsey & Company.

Over the past two years, almost all European flat steel producers have announced the gradual replacement of their coking coal (DC) blast furnaces with direct reduced iron (DRI) plants to decarbonise production. Over 16 announced DRI plants represent over 25 million metric tons of capacity.

For many of the newly built DRI plants, the original intention was to use natural gas (NG) as a feedstock or reducing agent to process ore into pig iron in an electric arc furnace (EAF) or submerged arc furnace. The iron will then be used in the Basic Oxygen Furnace (BOF) to produce flat steel.

This DRI production route using renewable electricity will allow players in the steel industry to cut their CO 2 Scope 1 and 2 emissions in half on average. In addition, CO2 prices have risen to over €100 per tonne of CO2, free permits for CO2 have been reduced and historical GHG prices of around €7 per gigajoule (GJ) will contribute to the competitiveness of alternative production routes over the next three to five years.

Using the example of Germany, DRI plants nearly doubled GHG demand to 175 petajoules (PJ) from around 120 PJ. One large DRI plant of two million metric tons would consume about one-fifth of the GHG currently used in the entire German steel industry (about 20 PJ) and would increase industrial demand for GHG in Germany by about 2%.

“Scaling up plants with direct reduced iron production using H2 or restoring carbon use and storage seems to be the most viable options for flat steel players to protect their decarbonization efforts,” the article noted.

GHG-based DRI plants can be relatively easily converted to run on green hydrogen to further reduce carbon emissions - less than 0.6 metric tons of CO 2 per metric ton of flat steel. As such, DRI plants are critical for European steel companies to achieve their carbon neutrality goals.

The war in Ukraine has resulted in a significant increase in GHG prices to EUR 36/GJ from EUR 7/GJ, which is likely to rise further. In addition, there are potential restrictions on the supply of GHG and an increase in the price of electricity to 0.36 euros per kilowatt-hour from 0.05 euros.

In addition, coking coal prices rise to more than 500 euros per metric ton from 170 euros.

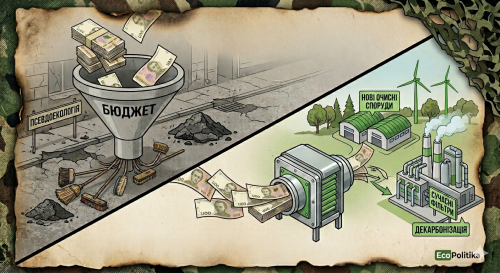

“Together, these factors mean that the feasibility, timing, and competitiveness of DRI GHG investments need to be reassessed, recognizing the impact on the decarbonization roadmap and the ability to meet the CO2 reduction targets set by metallurgy players,” the report says.

Four potential scenarios for influencing the creation of DRI plants:

- Scenario A: Slow transition Defer investment and focus on phased decarbonization of existing assets;

- Scenario B: transition acceleration – transition to hydrogen;

- Scenario C: transitional shift – transition to carbon recovery and storage (CCUS);

- Scenario D: transitional displacement - transition from basic to round steel.

In Scenario A, flat steel players could potentially find it difficult to achieve their decarbonization targets due to the limited potential for gradual decarbonization measures. Scenario D is likely limited due to the lack of additional (high quality) steel scrap.

The paper noted that scenarios B and C are the most viable options for flat steel players to protect their decarbonization efforts.

For Scenario B, getting timely access to enough H2 would be a key success factor. The German steel industry will need more than 14 terawatt hours of green hydrogen in 2026 to replace the planned GHG. In Europe, this number will increase to over 32 terawatt-hours, which corresponds to about 66% of the advertised pot capacity in Europe.

Ensuring early access to green hydrogen becomes even more important as it is the only direct alternative to GHGs.

“When examining the competitiveness of NG-DRI-EAF, H2-DRI-EAF and BF-BOF routes at different NG and CO 2 prices, the H2-DRI-EAF route is already NG-DRI-EAF cost-competitive at EUR 15 GJ and CO 2 100 euro per metric ton,” the article says.

Natural gas and CO₂ prices have a major impact on the competitiveness of DRI-EAF hydrogen and natural gas production.

Under Scenario C, applicability is likely to depend on customer acceptance factors for green steel based on CCUS and capital cost effectiveness to ensure a financial return on investment within a likely limited customer acceptance window. CCUS investments require a minimum period of five to ten years, however, it will take time for stakeholders to agree and obtain the necessary permits.

Recall scrap and hydrogen can cut metallurgy emissions by 73%

As EcoPolicy reported earlier, at EUROFER explained how the next steps to ETS and CBAM will impact the green steel.