National Power Company "Ukrenergo" has successfully made its first payment of interest on green and sustainability-linked Eurobonds in the amount of $28.4 million.

This was announced on Tuesday, May 10, by the press service of the company on its Facebook page.

Holders of securities received payment according to the calendar of the terms and conditions of Eurobonds. Eurobonds were issued in November 2021.

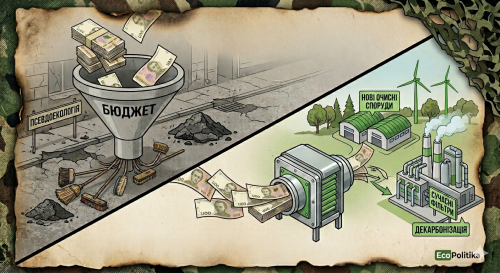

Ukrenergo fully used the raised funds to repay the debt to SE Guaranteed Buyer for the service of increasing the share of renewables.

“We highly appreciate the trust of our investors, who are confident in Ukrenergo’s stable operation under the difficult circumstances that currently exist in Ukraine and the electricity market in particular. For our part, we are doing everything necessary to ensure the financial stability of the Company and fulfil our obligations to investors who support the development of renewable energy sources and our power industry in general,” said Volodymyr Kudrytskyi, CEO of NPC Ukrenergo.

Recall that NPC Ukrenergo issued its first 5-year green and sustainability-linked Eurobonds in the amount of $825 million and a coupon of 6.875%.

It is the largest issuance of Eurobonds ever made by Ukrainian corporate and the largest issuance of green Eurobonds in Ukraine and CIS. In addition, among Ukrainian issuers, these are the first securities that are both a tool for investing in green energy and sustainable development.

Before EcoPolitica reported that the National Power Company "Ukrenergo" placed on the London Financial Exchange 5-Year Green Eurobonds for Sustainable Development (Green and Sustainability-linked bonds) in the amount of $825 million at a rate of 6.875%.

Let us also recall that the permanent representatives of the EU highlighted position of the European Council about the proposal to create European green bonds.