China will face a $6.5 trillion shortfall in green financing over the next 40 years as it seeks to achieve carbon neutrality by 2060.

This is stated in the report of the World Economic Forum (WEF) and the consulting company Oliver Wyman, informs Suth China Morning Post.

To achieve China's climate goals, it is necessary to raise about $20.75 trillion from green bonds and other environmentally friendly financing tools to become carbon neutral until 2060.

This means that between 2020 and 2060, a funding gap of $160 billion needs to be filled annually to finance green innovation across all sectors, including electricity, steel, mobility and construction.

“China’s net-zero commitment will require a revolutionary transformation of its economy driven by the widespread adoption of green technologies, all of which will require enormous investment,” said Qian Hang, a partner at Oliver Wyman in a statement on Thursday. “China’s unique economic model will shape this transition.”

The article noted that China's green transition is unique compared to the US and EU countries due to its industrialized economy. Industry accounts for more than a quarter of China's GDP, far higher than the US's 10.9%, the EU's 14.9%, and the global average of 15.9%.

"Its transition to net-zero carbon emissions, therefore, will require massive funding to support substantial technological breakthroughs in carbon-heavy sectors," according to WEF and Oliver Wyman.

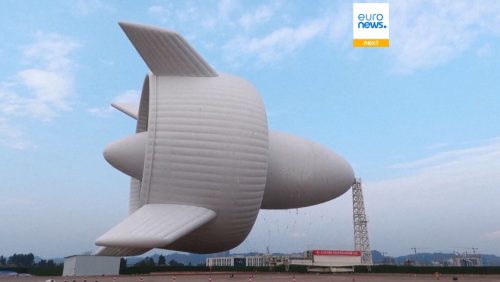

Yes, the energy sector, which accounts for almost half emissions of greenhouse gases in China, faces a financing gap of $2.2-30 trillion by 2060. Investments in RES can significantly reduce emissions in the energy sector and contribute significantly to achieving the goal of net zero emissions by 2060.

China's unique model of economic governance will also help shape the transition to zero net profit.

"Top-down economic planning by central and local governments is more conducive to long-term investment, and the state-owned enterprises will play an important role due to their substantial market share in the carbon-heavy industries needing to transition and the financial services that will have to finance this transition, said Qian," said Qian.

He also added that government financing will also play a more significant role in China.

One of the key reasons for the funding gap is a mismatch, particularly between the types of financial instruments, deal structure and timing.

Bank lending is the backbone of corporate finance in China. But in order to avoid risks, banks, as a rule, provide loans to large state and private enterprises. This makes it difficult to obtain sufficient financial support for small and medium-sized enterprises, which account for 65% of total emissions in China.

A dearth of quality data and a lack of clear policy support and supply chain collaboration are also key challenges to overcome.

“While the road ahead is steep, if China gets this right, it could drive the next green revolution globally, given the country’s scale and position in the global economy and supply chains,” said Kai Keller, platform curator of the WEF Beijing Representative Office. – “This will require significant innovation in financing, adequate policy support, and cross-industry collaboration.”

Comprehensive government support when it comes to taxation, land, administrative approval and financing can significantly help China's green transition.

Financial institutions must also innovate green financial products to better match demand. This could include new term structures, collateral requirements, instrument archetypes and portfolio strategies to ease the shortage of equity green finance and long-term green loans in China.

Businesses should also work with their value chain partners to set more holistic emissions reduction targets, especially covering their Scope 3 emissions – indirect emissions across the value chain, the report concludes.

Earlier, EcoPolitic wrote, that in China, the total trading volume of the national carbon market since its launch in 2021 reached 194 million tons.

As EcoPolitic previously reported, in China, Shanghai Industrial Gases Chemical Industrial Park invests more than €200 million in the construction of two hydrogen production plants.