Analysts believe that to UN Climate Summit COP27, which will be held on November 7, 2022 in Sharm el-Sheikh, Egypt, the pressure on governments will be increased to detail their green transition plans, taking into account all the challenges.

However, due to inflation, the uneven recovery from COVID-19, high food prices, global conflicts and the energy crisis, expectations for significant breakthroughs are low, the analyst firm CRU reports.

The article noted that COP26 was about commitments, while COP27 will have to focus on implementation. Analysts expect the negotiations to be difficult.

Issues related to losses and losses caused by climate change have not been resolved and remain a key stumbling block. However, some key themes are likely to emerge that can have a significant impact on business decision making.

Loss and damage will be a central theme of COP27

Analysts expect that COP27 will see much debate surrounding loss and damage – i.e., who should pay for the harm caused by climate change. In 2009, richer nations pledged to “mobilise” $100 bn in “climate finance” annually by 2020, to help emerging nations mitigate and adapt from the impacts of climate change. This target was missed and remains a contentious issue. Progress at the June 2022 Bonn UN climate talks was modest, with limited compromise found.

The Egyptian government has stated its goal of boosting and highlighting casualties and losses. Mobilizing capital for emerging markets and economies will be widely discussed at this climate summit.

In addition, there is a growing focus on case destruction and asset release, especially among institutional investors, who usually have long-term holdings. The call for more blended finance - to reduce the risk of investment for the private sector - is growing.

The Organization for Economic Co-operation and Development (OECD) defines blended finance as the strategic use of development finance to mobilize additional finance for sustainable development in developing countries. This could encourage private sector capital flows to riskier green investments in these regions.

Methodologies and framework

Redirecting capital flows towards green technologies and sectors will require improved frameworks and regulations. Globally, many exchanges and investors are calling for standardised and mandatory disclosure of corporate emissions, detailing of transition plans, and reporting of green revenue streams.

Nature and biodiversity

Over the last few years, there has been an increasing focus on two other important environmental issues – the dramatic degradation of nature and loss in biodiversity. The UN Biodiversity Conference in Montreal in December 2022 could prove significant in raising commitments and ambitions, with implications for businesses in commodity markets. These issues are interrelated with climate issues, with nature being affected by climate change and a partial solution to it.

This can harm the supply chain.

COP27 will not address these issues directly, but analysts expect it will help set the stage for the Montreal conference in a few weeks.

Adaptation needed as emission reductions far off target

The 2015 Paris Agreement was about temperature outcomes. COP26 in 2021 tried to keep a 1.5°C future possible. However, current nationally defined contributions (NDCs) do not get us close.

According to the United Nations Framework Convention on Climate Change (UNFCC), based on current NDCs, global emissions would rise by 2030 – and not decrease by the 45% needed to limit the increase of global temperatures to 1.5°C above pre-industrial levels.

“Even limiting the world to 2.0°C warming is under threat. There will be pressure at COP27 to enhance commitments, but we do not expect any major increase in ambition given the multiple headwinds,” analysts said.

They explained that policymakers, especially in developed countries, have been focusing on climate change mitigation. However, there is growing awareness that climate change mitigation is no longer enough. Societies and economies will need to adapt to climate change and the increased shocks from events such as record heat waves, storms and droughts that they bring.

“We expect climate change adaptation to be a key issue at COP27. It will be necessary to mobilize huge amounts of capital,” the article says.

Adapting to climate change could lead to significant changes in construction, infrastructure and transportation markets around the world. This will not reduce the need for continued and significant increases in mitigation spending, but it will be a competing financial factor for governments with stretched budgets. The adaptation may also affect the valuation of assets, as preferential prices will appear for less vulnerable assets.

Carbon prices could help channel capital

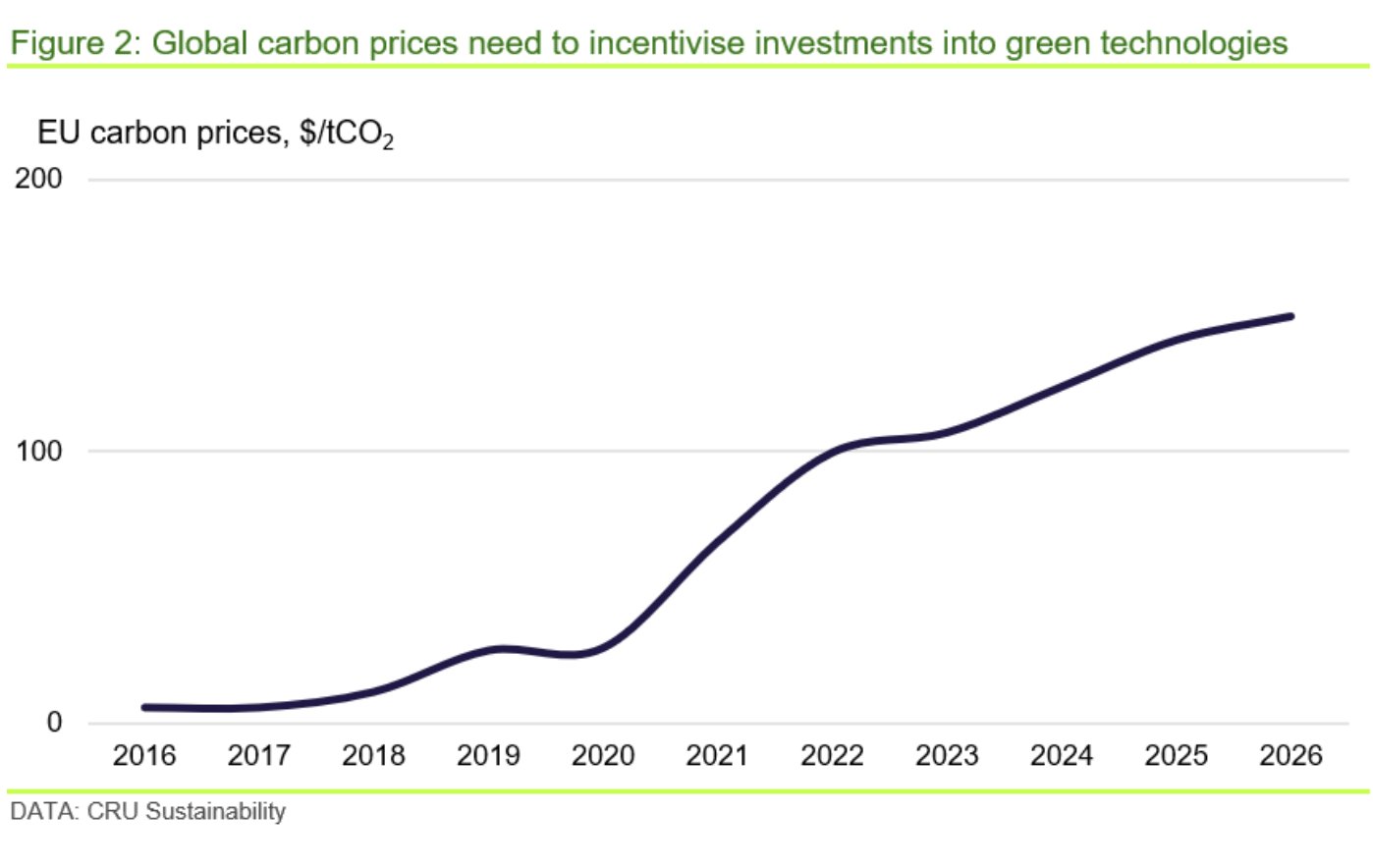

Analysts believe carbon prices could help channel capital into green technologies. The role of a higher carbon price, as in Europe, is to raise the cost of fossil fuel-based energy so that more expensive non-fossil fuel alternatives become economically viable.

Carbon pricing schemes are considered one of the most effective ways to reduce carbon emissions. They play a key role in government policy toolboxes to combat climate change.

Energy transition is central to climate goals, but progress is slow

Energy will be at the center of COP27 negotiations. To decarbonize the world, we need to radically change the way we consume and produce energy. However, the vital and fragile nature of energy markets came into sharp focus when prices soared in the wake of Russia's full-scale invasion of Ukraine.

High energy prices will hamper short-term decarbonization efforts, reducing the potential for ambitious COP27 commitments. However, they will promote the development of low-carbon alternatives, namely renewable energy and electric vehicles.

Emission reduction curve

Another important aspect of energy markets is the need to increase the share of electricity in primary energy. New zero-purity compatible technologies such as green hydrogen, electric vehicles and heat pumps will consume massive amounts of electricity. This will put additional strain on the grid at a time when the transition to low carbon alternatives will make a dramatic difference.

Coal

Analysts predict that globally, the share of coal generation in the electricity mix will decline to 34% in 2022 from 35% in 2021, mainly due to a drop in China. However, coal will be actively used in the global energy market in the medium term. COP27 is unlikely to lead to significant changes in the coal markets.

Key themes will emerge in potentially difficult negotiations

"We expect losses and losses, a fair transition and pressure for more funding for emerging markets from richer countries to take center stage in Egypt," analysts predict.

The material noted that the negotiations will be tense, but progress in structures and methodologies could be a bright spot. Other key themes include more discussions on adaptation along with mitigation and greater attention to nature and biodiversity.

As reported EcoPolitic previously, on the eve of COP27 stress on compensation for the damage done is growing to the world's poorest people by climate change.