Ukraine's carbon pricing system should be as close as possible in architecture to the European emissions trading system (EU ETS).

This and 4 other basic principles for the successful launch of the national emissions trading system (ETS) were formulated by GMK Center experts in their new study "Carbon Pricing and Decarbonization Financing in Ukraine and the EU".

They believe that the main goal of the Ukrainian ETS should be to adapt Ukraine's economy to the future accession to the EU ETS. Such adaptation should include:

- enterprises gaining experience operating within an ETS;

- preparing the necessary governance institutions;

- creating financing tools for decarbonization;

- reducing the carbon intensity of industrial sectors to European levels.

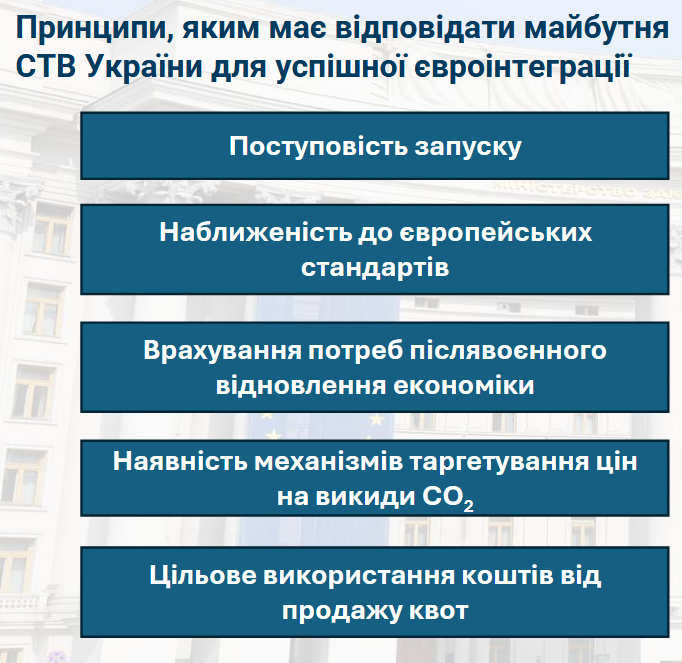

5 key principles that Ukraine's future ETS should meet for successful European integration

According to GMK Center experts, the basic principles should be as follows:

Source: gmk.center.

-

Gradual implementation.

This principle requires several components:

-

the existence of a functioning emissions monitoring and verification system;

-

adoption of Ukraine’s updated Nationally Determined Contribution (NDC2);

-

organizational measures such as recruiting and training personnel;

-

a gradual increase in fiscal pressure on emitters.

-

Alignment with European standards.

At the same time, the experts emphasized that when introducing European climate regulation mechanisms, the specific conditions in Ukraine must be taken into account:

-

higher carbon intensity of production compared to the EU;

-

export-oriented economy;

-

enterprises lack sufficient internal financial resources for decarbonization and cannot attract external funding on preferential terms;

-

the effects of the war on the economy;

-

instability of Ukraine’s energy system due to attacks;

-

immaturity of the state governance system in Ukraine;

-

a shortage of qualified specialists who could potentially maintain the operation of the ETS.

-

Consideration of post-war economic recovery needs.

GMK Center notes that even after the current hot phase of the war ends, the threat of renewed aggression will remain, meaning Ukraine will have to maintain a high share of military spending in GDP for a prolonged period to develop its defense capabilities.

-

Existence of price-targeting mechanisms for CO2 emissions.

-

Targeted use of proceeds from quota sales.

Experts emphasized that in 2023, revenue from the sale of emission allowances under the EU ETS amounted to €43.6 billion, of which €10.3 billion was allocated to special funds that finance the green transition, and the remaining €33.3 billion was received by EU member states. From June 2023, they are obliged to spend EU ETS revenues only on climate projects. According to experts, Ukraine should also introduce a targeted emissions tax.

"As a result, Ukraine should move to the European level of CO2 prices and join the EU ETS. The carbon tax for the sectors covered by the ETS should be canceled," the experts are convinced.

Earlier, EcoPolitics reported that €102 billion is needed to decarbonize the domestic industry, and Ukraine is unable to accumulate such funds without EU support.