The main difference between the cross-border carbon adjustment mechanisms (CBAM) is that in the UK it is a tax mechanism, while in the European Union it is a market mechanism.

The analysis of approaches to carbon regulation in the EU and the UK was conducted by experts of the Redshaw Advisors platform.

What is CBAM?

The Cross-Border Carbon Adjustment Mechanism (CBAM) is a political instrument. Its purpose is to equalize the price of carbon between domestically produced and imported products. This mechanism is introduced to ensure that a jurisdiction's climate goals are not undermined by the transfer of production to countries with less ambitious climate change policies.

The embedded emissions of goods subject to this regime must be measured, reported, verified and ultimately offset through an appropriate instrument.

Briefly about the European CBAM

Goals:

- combating carbon leakage;

- support of the EU Green Course and zero emission goals;

- encouraging global climate action.

EU CBAM covers carbon intensive sectors:

- ferrous metallurgy;

- cement;

- aluminum;

- fertilizers;

- electric energy;

- hydrogen.

During the transition phase (2023-2025), only emissions measurement and reporting of embedded emissions of exposed goods are required.

Full implementation from 1 January 2026 will require importers not only to report emissions, but also to purchase CBAM certificates that will reflect embedded emissions in imported goods covered by CBAM. For countries with carbon pricing, adjustments will be made to ensure fairness.

Briefly about the British CBAM

Like the EU's CBAM, the UK version puts a carbon price on imported goods, particularly from carbon-intensive sectors such as iron and steel, cement, aluminium, fertilizers and hydrogen, to ensure the same carbon costs are incurred on foreign goods as on domestic goods. production

But there is a difference: CBAM in the UK allows adjustments to be made based on carbon pricing already in place in the exporting country.

Terms of implementation

The EU CBAM started with a transitional phase on 1 October 2023. It provides quarterly reporting. During the transition period, which is due to end on 31 December 2025, CBAM certificates do not need to be submitted.

From January 1, 2026, the final period will begin, and the reporting and accounting periods will be converted to an annual basis. At this stage, importers will submit CBAM certificates in an amount equivalent to the embedded emissions in the imported good covered by the CBAM.

The UK CBAM has no transition phase and will go directly into the final phase from 1 January 2027. This means that importers are obliged to pay the corresponding tax directly from the moment the mechanism is launched.

The UK CBAM's first reporting period covers a full year (ending 31 December 2027). However, importers will have until 31 May 2027 to file the first declaration and pay the CBAM covering the first reporting period.

After the first reporting period, starting in 2028, CBAM UK will switch to quarterly reporting periods.

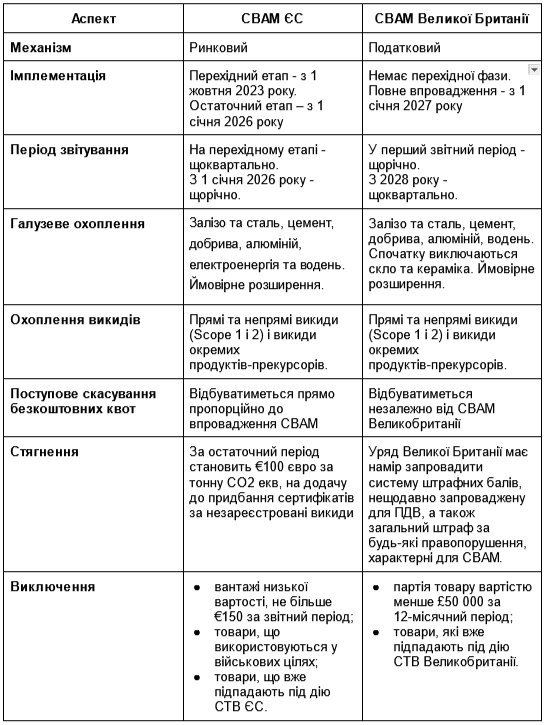

Comparison table of CBAM in the EU and Great Britain

In October, EcoPolitics wrote that the new UK Labor government was looking for ways to circumvent CBAM. Earlier, we also reported on the UK's intention to introduce its own analog of the European Carbon Based Import Adjustment Mechanism (CBAM) in 2027.