To successfully implement the green transition, Ukraine should follow the European example and move to a targeted tax on industrial emissions.

This is the reasoned opinion expressed by GMK Center analysts in their new study Carbon Pricing and Decarbonization Financing in Ukraine and the EU.

Why the eco-tax in Ukraine does not contribute to the eco-modernization of industry

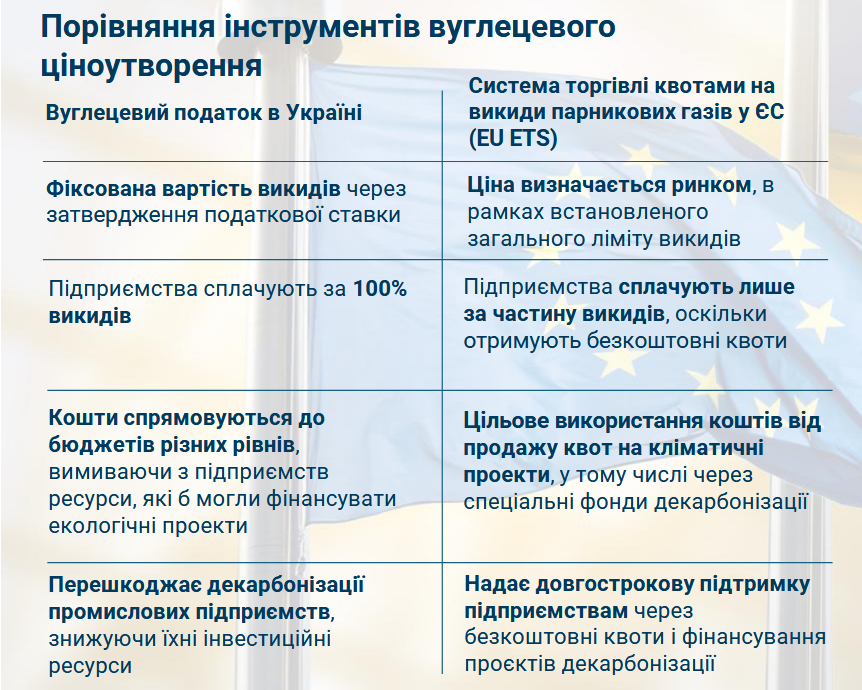

Experts have stated that carbon pricing instruments in Ukraine and the EU are fundamentally different. They summarized the main differences in the table below:

Source: gmk.center.

According to GMK Center experts, a major problem is that carbon tax revenues are currently being accumulated in the budgets of different levels. As a result, industrial enterprises lose financial resources that could be used for eco-modernization of production.

And the state Decarbonization Fund, which partially receives these funds, is unable to finance projects of large industrial enterprises due to a lack of funds and the insufficient amount of the maximum loan of UAH 90 million compared to the needs of large producers.

"In Ukraine, the carbon tax is a purely fiscal instrument that limits the ability of enterprises to implement decarbonization projects," GMK Center says.

In the EU, the EU ETS greenhouse gas emissions trading system accumulates funds that are then used to implement green transition projects.

Targeting emission fees as a prerequisite for decarbonization

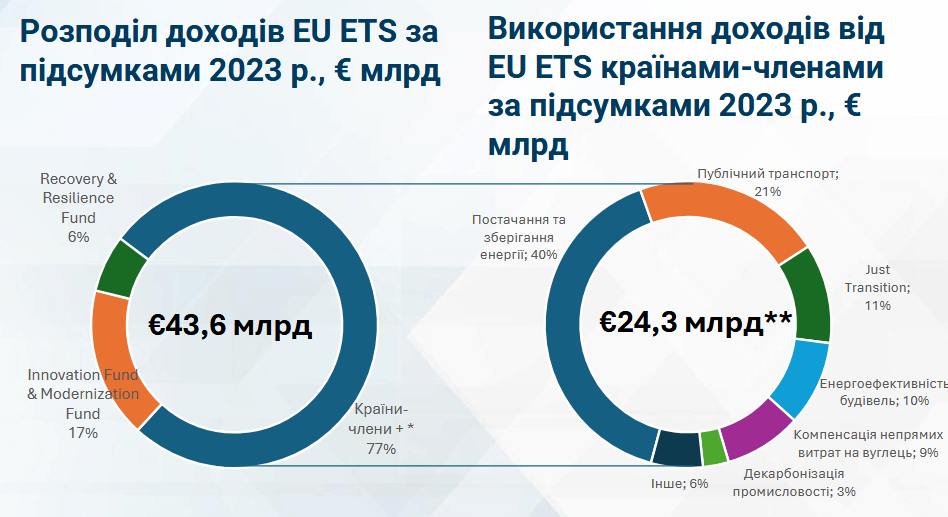

GMK Center experts analyzed the European Commission's report on the functioning of the European carbon market in 2023 and created an infographic of revenues and subsequent distribution of EU ETS revenues:

* – including Iceland, Norway, Northern Ireland, and Liechtenstein

** – used by member states from the total revenue of €33.3 billion in 2023, including the amount for indirect carbon cost compensation

Source: gmk.center.

The total amount of revenue from the sale of emission allowances under the EU ETS in 2023 amounted to €43.6 billion. These funds were divided into two parts:

- €10.3 billion was allocated to special funds that finance the green transition (Innovation Fund, Modernization Fund, Recovery & Resilience Fund);

- €33.3 billion was allocated to member states*. Starting in June 2023, they are obliged to spend revenues from the emissions trading system only on climate projects. These expenditures are strictly controlled by the European Commission.

"That is, the EU ETS revenues are earmarked for the needs of the green transition. In fact, the EU ETS is not only a tool that provides financial pressure on issuers, but also a means of accumulating financial resources for decarbonization needs," the experts stated.

That is why they are convinced that Ukraine should also introduce a targeted emissions tax in its pursuit of European integration.

Earlier, EcoPolitic reported on the cost of the green transition for the Ukrainian metallurgical industry. We also published expert explanations on why Ukraine will not cope with the decarbonisation of its domestic industry without support from the EU.