Indonesia's domestic carbon exchange has opened trading to foreign participants, with 9 foreign buyers already participating in transactions.

This is reported by Bloomberg.

The first official carbon exchange in Indonesia, IDX Carbon, operates on the Indonesian Stock Exchange. It has started offering domestic credits from 5 energy production projects owned by the utility PT Perusahaan Listrik Negara (PLN).

On January 20, IDXCarbon published a list of more than 1.7 million domestic carbon credits. The Indonesian permitted carbon credits are generated through energy efficiency efforts at PLN's facilities, including gas-fired power plants and mini-hydroelectric power plants.

Iman Rahman, president of the Indonesia Stock Exchange, told local media that the exchange expects carbon trading volumes to reach 500,000 to 750,000 tons this year, including both domestic and international buyers.

Plans for the future

According to Environment Minister Hanif Faisol Nurofik, Indonesia plans to add carbon credits related to forestry and land use as early as March. These credits, derived from peatland conservation and reforestation projects, are likely to be sold at a higher price than existing products, the official said.

Seeking billions of dollars in revenue from the carbon sector, President Prabowo Subianto has pledged to accelerate by 10 years the country's current goal of reaching zero emissions by 2060.

According to BloombergNEF, Indonesia will need to invest $3.8 trillion in renewable energy, grid capacity, and electric vehicles to reduce its emissions to zero by mid-century.

Indonesia's place on the market

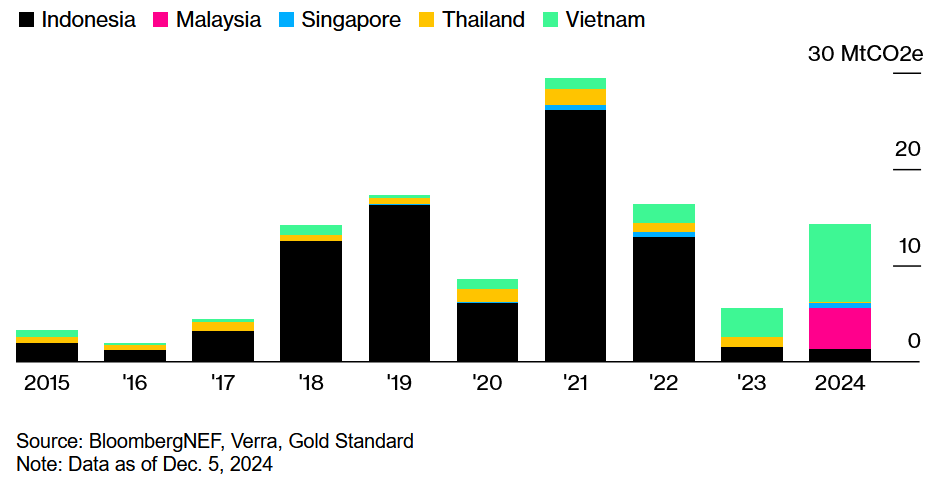

The publication is convinced that the country seeks to restore its positions as the main carbon emissions center in Southeast Asia and attract more investment for local climatic action. Carbon centers of Southeast Asia

Source: bloomberg.com.

Indonesia was one of the largest suppliers of voluntary carbon quotas in Asia before exports were restricted in 2022. The BNEF data indicates that companies such as Volkswagen Ag and Shell Plc were one of the largest buyers of national quotas.

Since its launch in September 2023, IDXCarbon has been suffering from low demand, partly due to Indonesia's delays in the introduction of quota trading system for emissions.

Indonesia's decision to open the market was made after at the COP29 Climate Summit in November has been reached agreements on the rules of trade between countries and permission to use loans to achieve their climatic goals.

As EcoPolitic reported before, Japan wants to achieve zero emissions of CO2 by 2050.