Trading volumes in the world's key emissions trading systems (ETSs) grew by 24% in 2024, a significant rebound from the stagnation seen in 2023.

These data are contained in the 2024 Carbon Market Review prepared by the London Stock Exchange Group (LSEG).

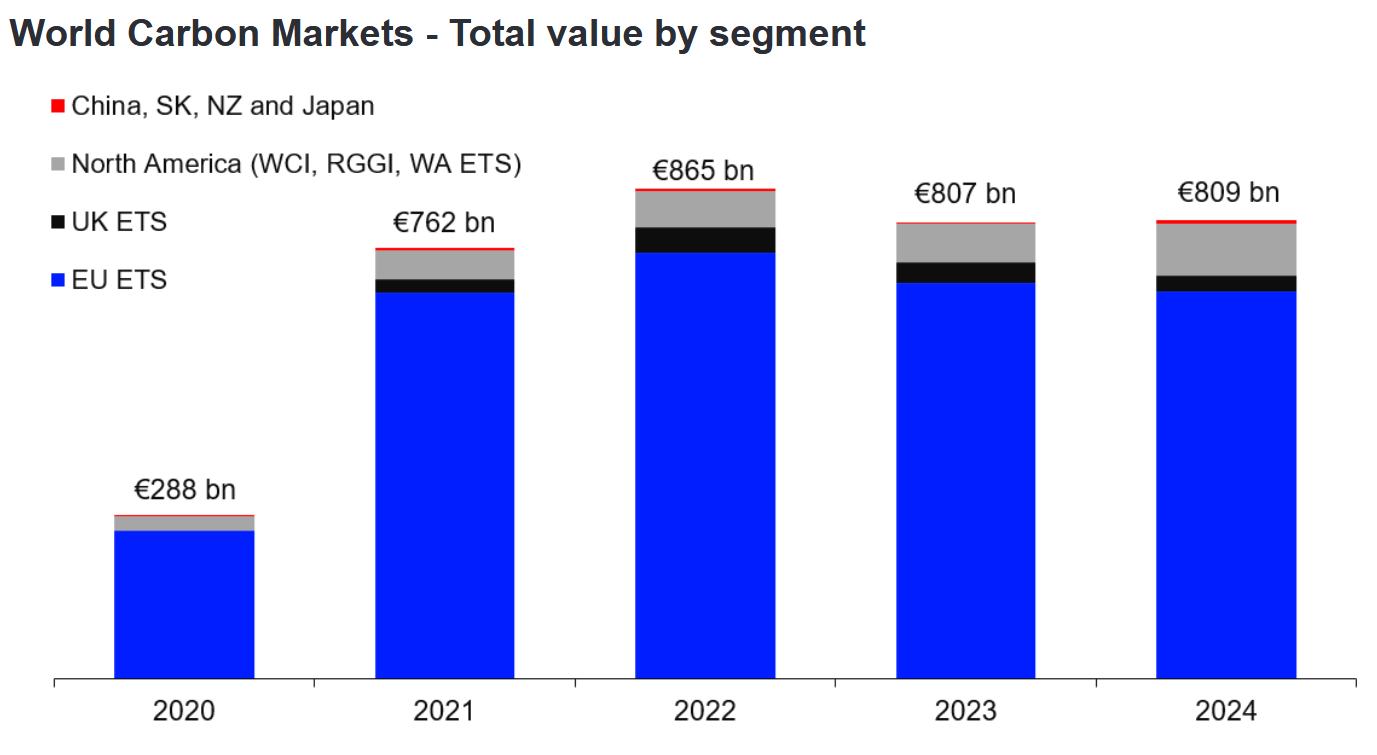

Analysts note that despite this surge, the total market value grew by only 0.3%, indicating a disconnect between volume and value.

Overall assessment of global carbon markets by segments in 2020-2024.

Source: lseg.com.

EU

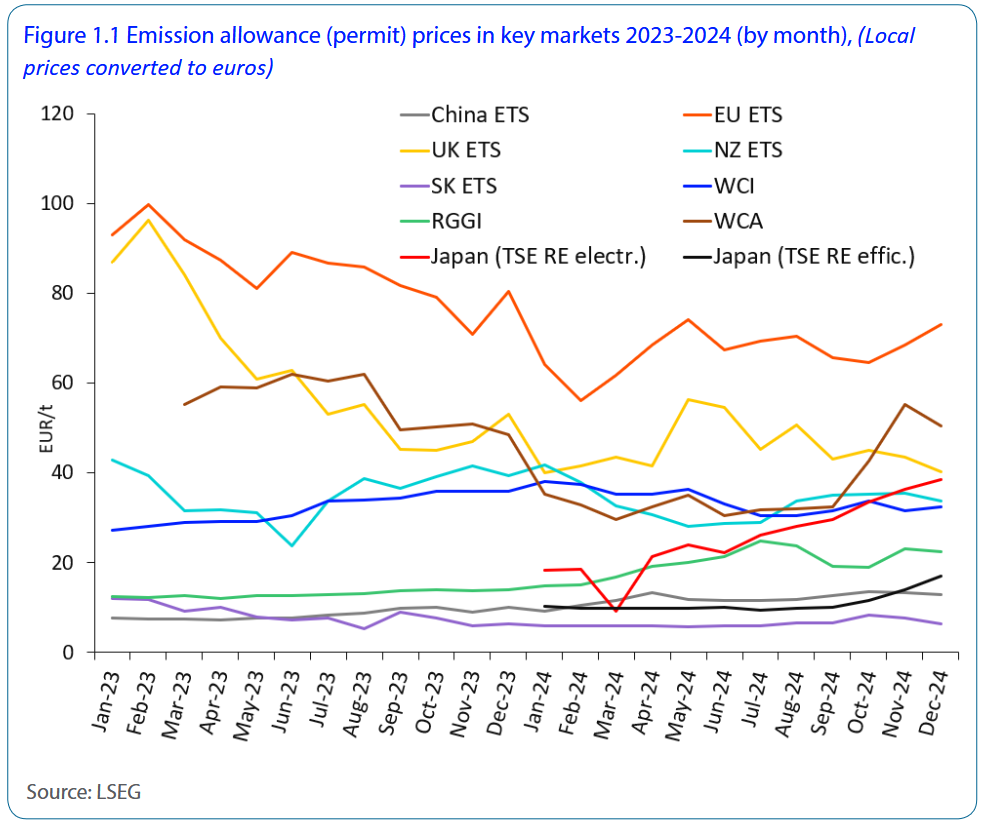

The EU ETS retained its dominance, accounting for 85% of the total value of the carbon market. However, the price here fell by 2%, primarily due to a drop in prices at the beginning of the year associated with lower European gas prices (TTF).

By mid-November, investment funds moved to a net long position in EUAs for the first time since July 2023, which led to a sharp rise in prices at the end of the year:

Source: lseg.com.

US President Donald Trump's stance on climate policy has already brought instability to the EU ETS as market participants prepare for potential disruptions in international cooperation.

“These developments raise concerns about the future of international carbon markets. The changing political landscape, especially in the US, is affecting regulated regional markets such as the EU ETS, creating uncertainty for market participants,” the report says.

UK

Meanwhile, the UK ETS fell by 28%, trading at a steady discount to the EUA. This decline was caused by negative market sentiment, which arose from uncertainty around expected reforms, in particular, the supply-side regulation mechanism.

New Zealand

According to experts, the most impressive growth occurred in New Zealand's ETS, where trading volumes soared by more than 300% due to the resumption of auctions and increased exchange activity. However, its market share – along with China and Japan – remained below 1%.

China

In contrast, volumes in China's ETS decreased by 6%. However, the country has made significant progress, including the creation of a full-fledged legal framework and plans to expand the ETS to the steel, cement, and aluminum sectors by the end of the year.

This strategic move aims to cover approximately 60% of national greenhouse gas emissions. Prices, however, remained largely static.

Asian countries

In other parts of Asia, markets developed along different trajectories, analysts say. South Korea's ETS remained stagnant, and prices did not change during the year. The authorities tried to limit excess quotas, but investment sentiment remained weak.

In contrast, Japan's carbon market grew sharply, and the carbon market on the Tokyo Stock Exchange (TSE) significantly increased both trading volume and prices in its first full year of operation.

India is preparing to launch a carbon market aimed at setting emission reduction targets for key industries. Its carbon trading scheme is key to fulfilling the country's Nationally Determined Contribution.

Despite taking preparatory steps to establish an ETS, Turkey has repeatedly postponed its launch, mainly due to slow progress in adopting legislation.

Voluntary carbon market (VCM)

This segment of the global greenhouse gas emissions trading market has been struggling with weak prices and declining demand for most of the year. It faced challenges related to concerns about the integrity, quality, and added value of carbon credits.

Analysts noted that despite market fluctuations, the outlook for the voluntary carbon market is improving. Confidence in it has increased after the adoption of the Article 6 framework at COP29, which increased the transparency of crediting and reduced the risk of double counting.

According to experts, to ensure the future of the VCM, it is necessary to align it with the rules established by the UN, and this trend is expected to continue until 2025 and beyond.

In November 2024, EcoPolitic reported that the COP29 climate conference approved new rules for creating a global carbon market. A little later, in December, we told you that Brazil had launched a carbon market, and Vietnam could officially launch its emissions trading system in 2028.