Researchers from the Potsdam Institute for Climate Impact Research analyzed the dynamics of carbon prices over 2008-2023 and made a reasonable assumption that the fall in the price of CO2 emissions in the EU is due to a loss of political trust among companies.

This is stated in the article "EU carbon prices show high confidence in policy and forward-thinking players" published in the journal Nature.

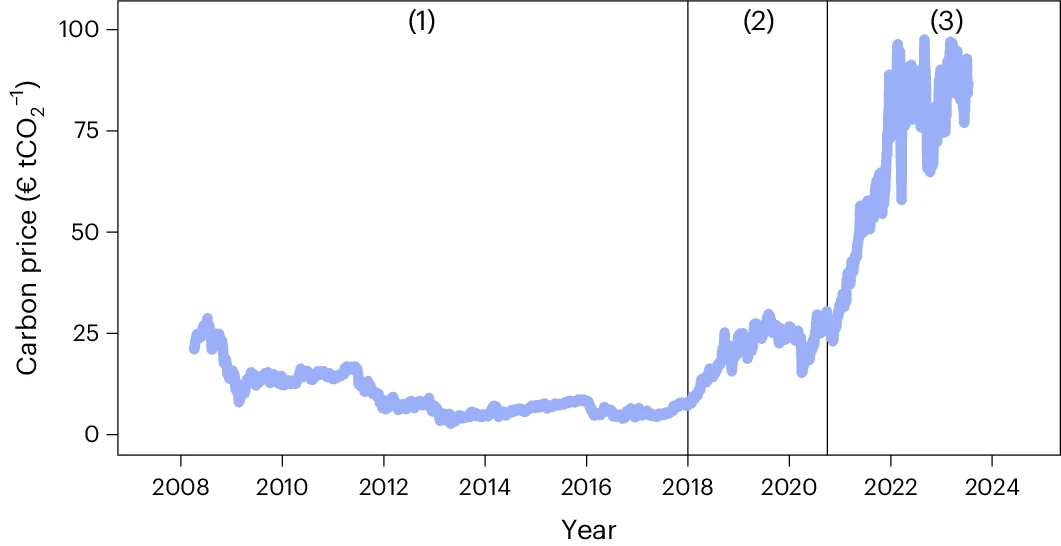

Analysts say that between 2017 and 2021, prices increased tenfold, exceeding €80 per ton of CO2-1 and changing investment decisions in the electricity sector and industry. In general, the dynamics of carbon prices in the EU ETS from 2008 to 2023 is as follows:

The collapse of prices for CO2 emissions in the EU at the end of 2023 puzzled observers.

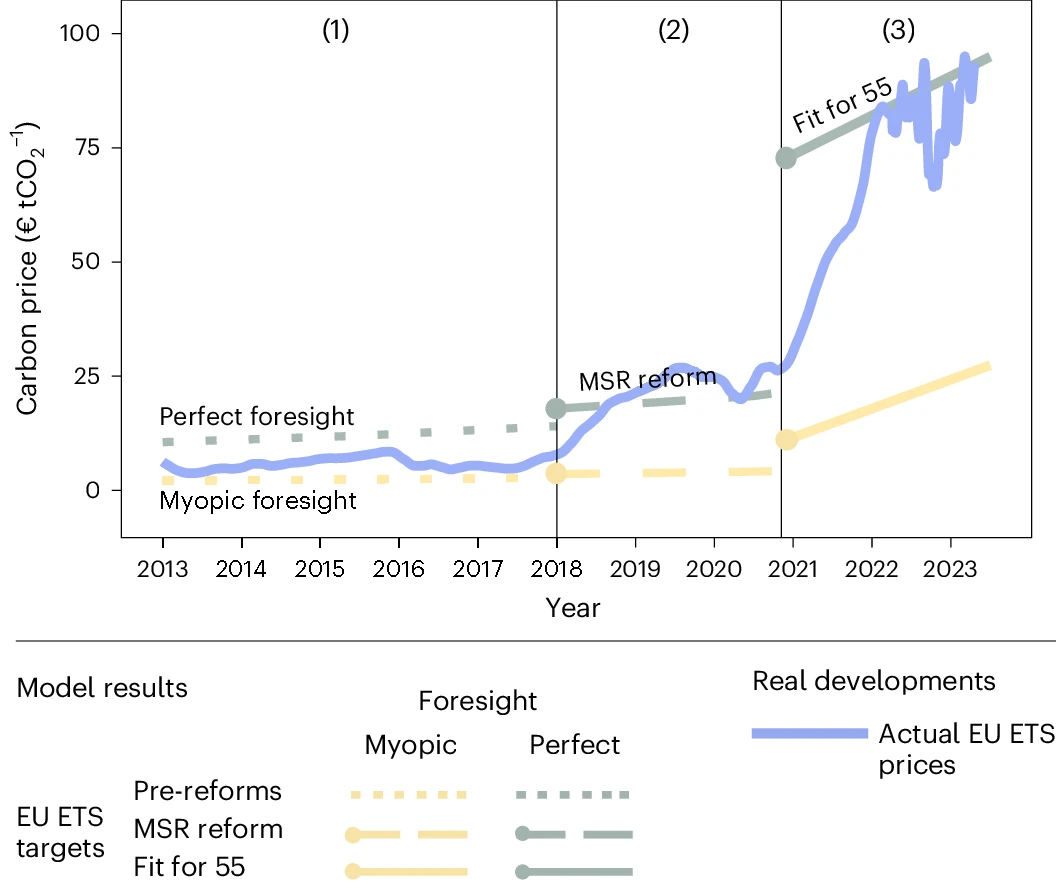

According to new simulations they carried out, the underlying price of EU CO2 emission allowances is significantly influenced by whether industry believes politicians' climate commitments are credible.

Using the LIMES-EU model, the research team showed "that the effect of political trust on price is significant," says Robert Pitzker, an energy systems researcher who co-authored the study.

"Decision-makers must consider trust as a key variable," he said.

Prior to this drop, the price of EU CO2 emission allowances had been steadily increasing in the 2020s. Conversely, this can be explained by the fact that companies at that time took the climate commitments of politicians seriously, according to the authors of the article.

In 2021, when the EU's sluggish CO2 price rose, the Commission's executive vice-president responsible for the Green Deal, Frans Timmermans, stressed that "if we want to reach our targets, I think the price should be much higher than it is even at the level of €50".

Markets "probably saw this as an important signal" that policymakers would not "interfere" in the carbon market to reduce prices to the level that existed by 2020, Pitzker said. As a result, carbon prices in the EU continued to rise, reaching a peak of €100 per tonne of CO2 in February 2023, after which prices began to slowly decline.

The impact of the reforms and predictions of the participants on carbon prices was shown by the researcher on the graph:

"If confidence in the EU's climate targets weakens, carbon prices could fall," explained Johanna Sitartz, a scientist at Germany's Potsdam Institute for Climate Impact Research who is the author of the study.

Analysts say that when politicians began to take the EU Emissions Trading Scheme (ETS) seriously, companies began to manage their certificates more far-sightedly, paving a clearer path to climate neutrality in industry and energy.

Industry representatives have a different opinion

Joachim Hein, who deals with carbon pricing at the German industry association BDI, says that ETS prices "have nothing to do with political trust".

Instead, he suggested that companies are reacting to new laws and associated uncertainty, such as the CO2 border tax (CBAM). They stock up on emissions certificates, and that's what pushes prices up.

Christian Müller, who deals with ETS at chemical giant Evonik, expressed similar doubts about the strong link between politicians' statements and CO2 prices:

"Of course you know there is a goal [of climate neutrality], but how will that be reflected in the ETS in the end?"

However, he also confirmed the main claim made by the carbon researchers: "We are also very forward-thinking in terms of our activity in the purchase of certificates."

In February 2023, EcoPolitic reported that in Europe the price of carbon emissions has increased to almost €100 per ton.