Analysis of the climate coalition Climate Leadership Council showed that the competitiveness of American firms could improve against the background of the launch of the European carbon import adjustment mechanism (CBAM).

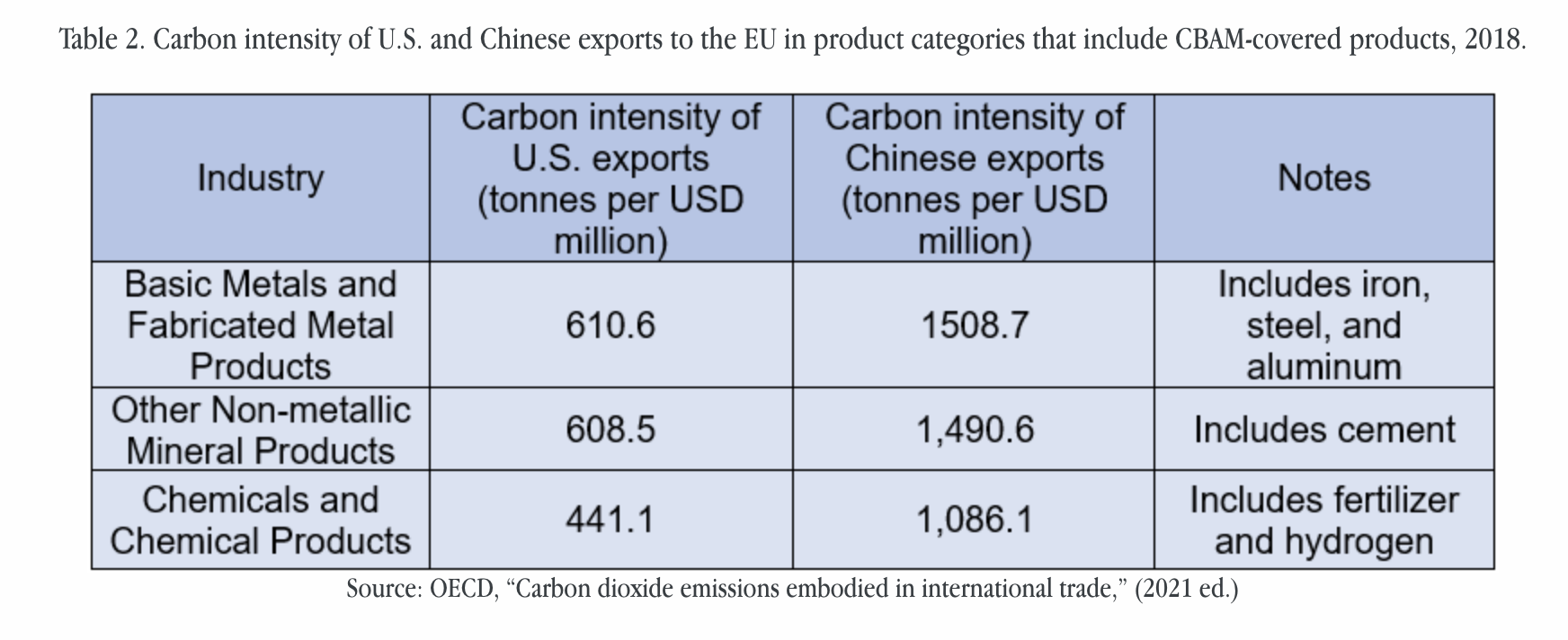

If the projected CBAM levy reaches $120 per ton of carbon emissions, US importers will pay about $0.3 billion, and Chinese importers will pay $3.4 billion, according to the Climate Leadership Council.

According to forecasts, Chinese imports would suffer about eleven times more than US imports. American firms can potentially replace Chinese manufacturers in the European market, as well as other trade competitors.

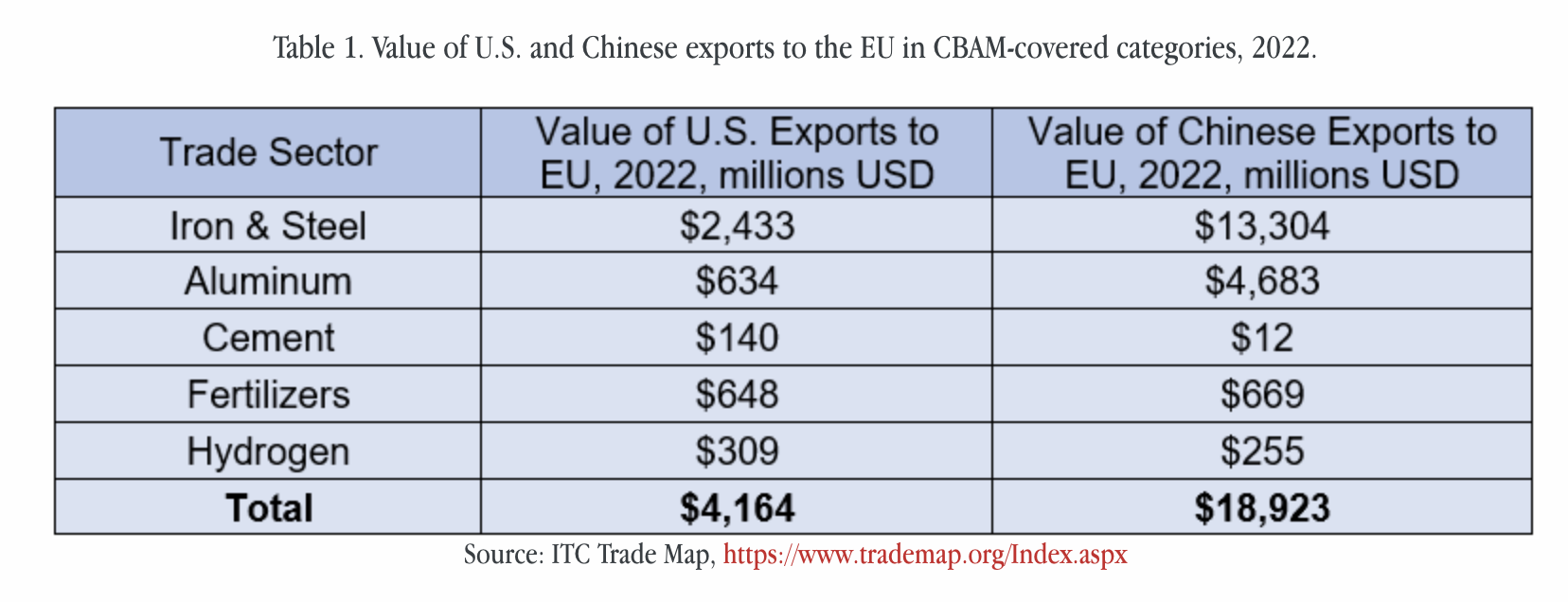

It is noted that the carbon tax will apply to emissions related to the production of iron and steel, aluminum, cement, fertilizers, hydrogen and electricity imported into the EU. This will affect only a portion of US exports to the EU. Thus, out of $350 billion of exports to the EU in 2022, only 1.1% ($4 billion) was subject to CBAM. The EU's largest trading partner in goods, China, in 2022 exported almost five times more goods covered by the CBAM, namely $19 billion.

The analysis showed that the introduction of a system of responsibility for the intensity of carbon emissions in sold goods will give preference to more efficient companies from the USA.

The authors emphasized that the true impact of CBAM will also depend on:

- implementation problems;

- data quality;

- ease of compliance;

- appropriate handling of confidential business information.

The material emphasized that the first stage of CBAM began on October 1, and importers must submit the first reports by January 31, 2024. They will face a fine of €10–50 per ton of unregistered emissions.

"Although the threat of compliance fees is aimed at obtaining more complete reporting, it could lead to price pressure on US producers who are unwilling or unable to provide sufficient information," the analysts said.

Earlier, EcoPolitic wrote, that Daniel Ferri, the spokesperson of the European Commission, said that on October 1, the transitional period of CBAM application began in the EU.

As EcoPolitic previously reported, one of the main climate policy tools of the EU is the CBAM carbon import adjustment mechanism, which is designed to level the playing field for companies subject to different climate norms and taxes.