With steel producing at least 7% of global carbon emissions, there is now increasing pressure on the industry to decarbonise.

How this affects the movement of the industry to more environmentally friendly steel and what are the three key points on the way to reducing carbon emissions in the industry – told the resource Wood Mackenzie.

The data is based on the latest steel decarbonization path report obtained from the Steel Research Suite.

1. Electric arc furnaces using zero-carbon electricity will come to dominate steelmaking

We believe more efficient electric arc furnace (EAF) technology, which is three-quarters less emission-intensive than a traditional blast furnace, will eventually dominate steelmaking. By 2050, we expect EAF production to be nearly on a par with (currently dominant) basic oxygen furnaces (BOF), as steelmakers gradually distance themselves from the conventional route.

The transition will be uneven, however. The onus will be on mature economies including China, Europe, Japan, South Korea and the US to decarbonise quickly. China will take the lead, halving its absolute emissions over the next 30 years thanks to both lower demand and more efficient production. In contrast, India and Southeast Asia – the key drivers of future demand – will buck the trend, doubling their emissions due to a tripling of output via the heavy emitter blast furnace route.

Chart shows green steel: electric arc furnace (EAF) technology to gain momentum as steelmakers abandon the basic oxygen furnaces (BOFs)

2. Scrap will emerge as the primary metallic for steelmaking

Using scrap in an EAF with a clean power source has the potential to be a near-zero emission route. That makes scrap the most sought-after metallic, and we expect demand for scrap to increase three times faster than overall metallics demand. Quality enhancements and retrofits will also potentially increase scrap blending in blast furnaces.

China will be a key consumer of scrap, lowering its dependence on hot metal in line with other major economies. However, there are limitations on the availability of scrap, as well as on quality improvements. That pivots the industry towards exploring new ways of abating emissions.

3. Hydrogen-based steel production will eventually account for 10% of global output

The use of hydrogen in steelmaking has real potential, although it is still a nascent technology and has yet to be exploited at a commercial scale. We project that by 2050, 40% of direct reduced iron (DRI) will be produced using a hydrogen as reductant.

The EU will take the lead in terms of adoption – Sweden in particular looks likely to be a trailblazer for net zero aligned steel production with green hydrogen at its heart. ArcelorMittal and SSAB are planning to commercialise the technology in 2026-27, having already conducted successful pilot tests. That will pose challenges including the availability of DR-grade pellets, refining to eliminate hazardous impurities, and the requirement for higher capital investment. As a result, adoption is likely to be slow in cost-sensitive markets.

Hydrogen also has potential for use in the BOF process as a partial replacement for the pulverised coal injection (PCI) method. That is unlikely to happen on a commercial scale until the early 2040s, but once it does it should quickly gain momentum, since the technology can be retrofitted to existing blast furnaces.

It is expected that hydrogen-based steel production will account for 10% of the total steel output by 2050, while carbon capture, utilisation and storage (CCUS) will help offset nearly 178 Mt of emitted carbon.

Experts forecast a 30% reduction of overall emissions – 25% at gross level and 5% offset via CCU – at the same time as steel production increases by 20%. That’s significant progress, but on this trajectory, emissions will still be around ten times higher than the level needed for a 1.5-degree global warming pathway.

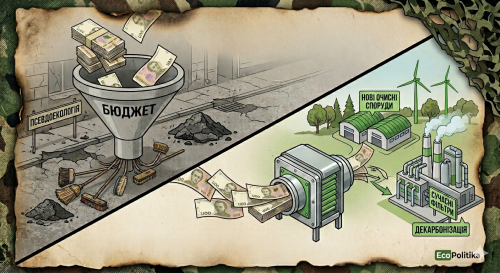

Earlier, EcoPolitics wrote that the aggression of the Russian Federation endangered Ukraine's plans for decarbonization. Further development of the process of decarbonization of the economy is impossible without the help of international financial organizations and EU investment funds.