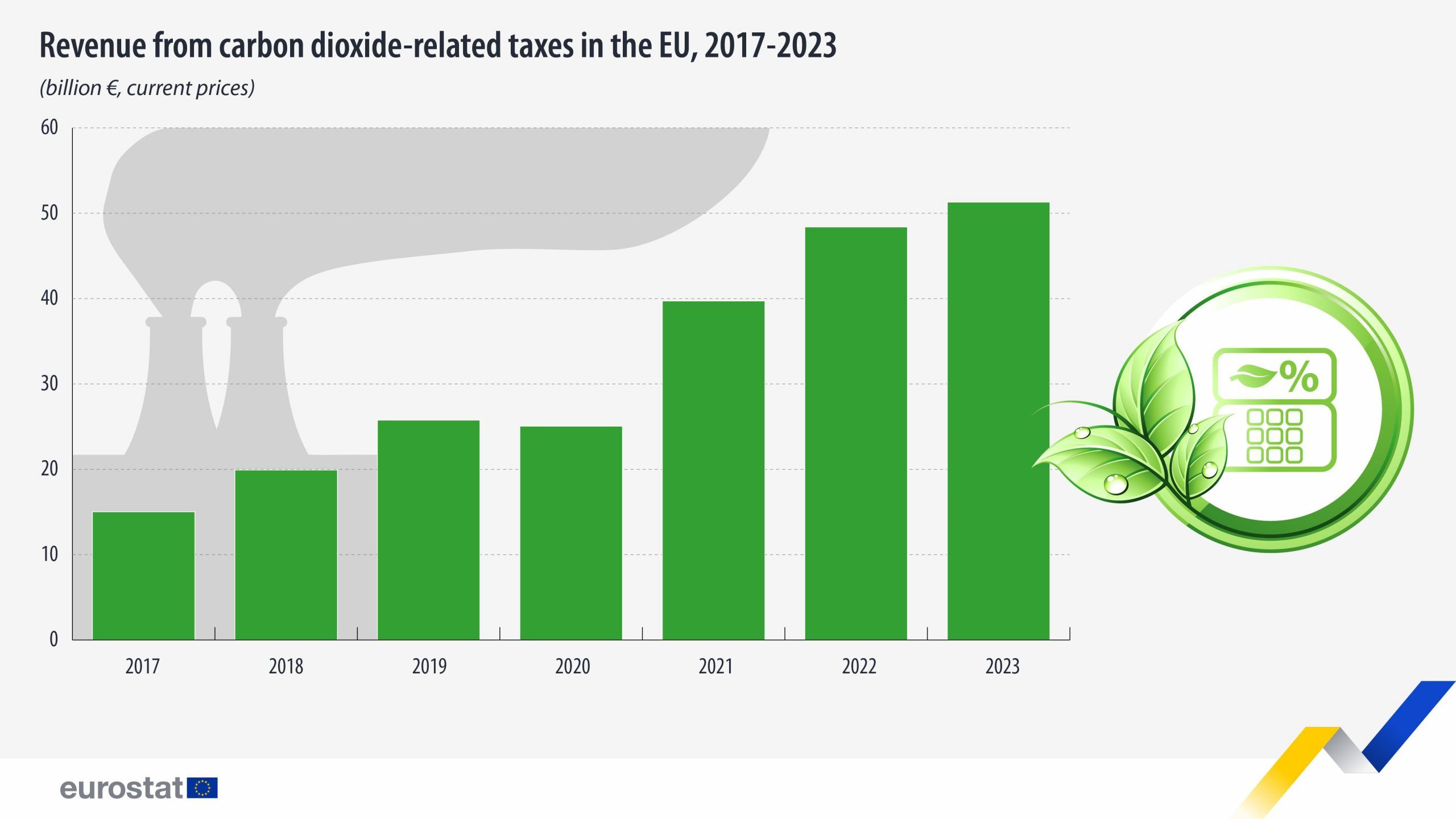

In the European Union, revenues from carbon taxes increased from €15 billion to €51 billion between 2017 and 2023. These taxes are levied on the CO2 content of the fossil fuels used by taxpayers.

This is according to data from Eurostat.

During the same period, the share of carbon taxes in the overall energy tax structure more than tripled, from 6% in 2017 to 19.7% in 2023.

Source: ec.europa.eu/eurostat.

Who pays more?

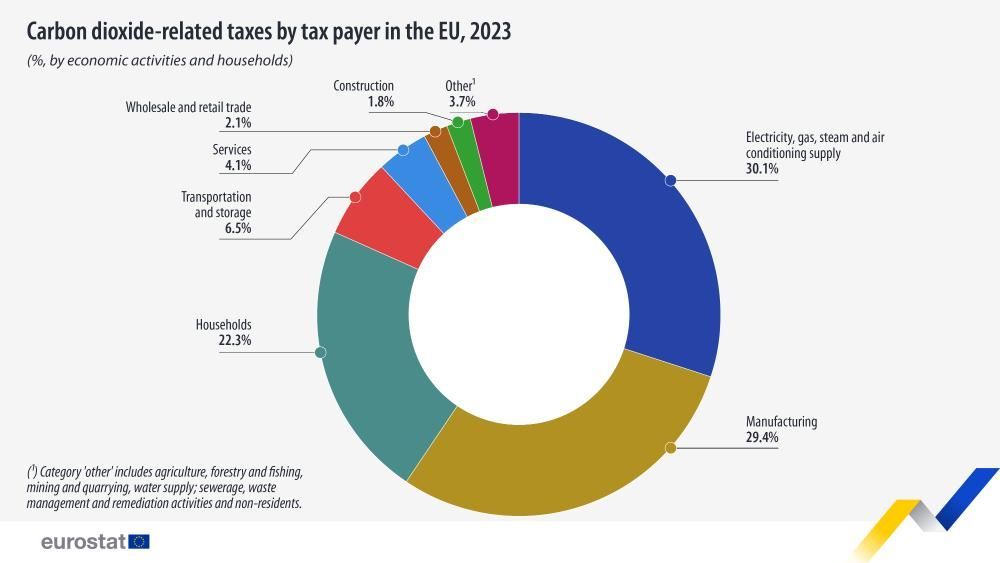

In 2023, EU households accounted for 22.3% of carbon tax payments. At that time, businesses paid the lion's share of carbon taxes – 76.4%. Non-residents of the European Union accounted for another 1.3% of revenues.

The energy sector was the largest payer of eco-taxes. Carbonization fees for the supply of gas, electricity, and steam accounted for 30.1% of this amount of revenue to the EU budget.

The manufacturing industry came in second place, accounting for 29.4% of carbon taxes paid.

EcoPolitic previously reported that, starting from January 1, 2026, the Carbon Border Adjustment Mechanism (CBAM) has entered into force in the EU. Within its first week of procedure, importers declared nearly 1.7 million t of goods.