An environmental tax should encourage businesses to modernize and help restore the environment. In Ukraine, this tool is often the subject of heated debate regarding its transparency and effectiveness. The situation arises where money seems to be available, but its positive impact on the environment must be sought with a magnifying glass or microscope.

In this article, we will analyze the history of the Ukrainian eco-tax, look at how much money the state collects, where these financial flows are then directed, and what systemic problems prevent it from being an effective tool for Ukraine's "green" transformation.

When was the environmental tax introduced in Ukraine?

This type of tax appeared in the Tax Code of Ukraine, which came into force on January 1, 2011. It replaced the environmental pollution tax.

Documents that define the basic principles of the eco-tax:

-

Tax Code of Ukraine:

-

Section VIII “Environmental Tax” (Articles 240–250): defines taxpayers, taxable items, tax rates, calculation procedure, and reporting deadlines.

-

Subsection 5 of Section XX “Transitional Provisions”: contains schedules for phased rate increases (for example, for discharges into water, which as of 2025 reached 100% of the base rate).

-

Budget Code of Ukraine: regulates the distribution of funds between the state and local budgets (Articles 29 and 64).

Who has to pay the eco-tax

These are enterprises and sole proprietors who:

-

emit pollutants into the atmospheric air from stationary sources;

-

discharge production waters into water bodies;

-

dispose of waste, except for the placement of waste as secondary raw materials on their own premises;

-

generate radioactive waste;

-

are generators of radioactive waste and temporarily store it beyond the period established by special license conditions.

The amount of eco-tax in Ukraine

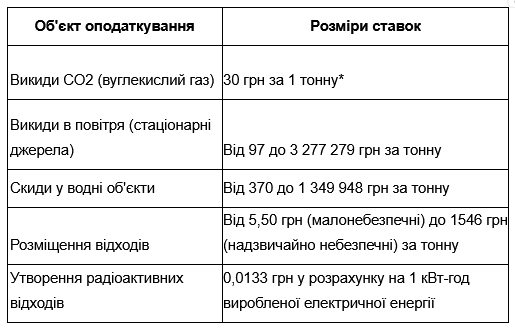

Tax rates depend on the type of pollution and the degree of danger of the substances. As of 2026, the following basic indicators are in effect:

* A threshold has been set for CO2 emissions: the tax is payable only if the volume of carbon dioxide generated exceeds 500 tons per year.

How environmental payments are distributed between budgets

Revenues from the environmental tax go to the state and local budgets.

The general distribution scheme is as follows:

-

45% – to the general fund of the state budget;

-

55% – to local budgets, of which:

-

30% – to regional budgets;

-

25% – to the budgets of rural, settlement, and city territorial communities (with an exception for Kyiv and Sevastopol, which each receive the full 55%).

-

There are categories of environmental tax that are fully allocated to the special fund of the state budget:

-

tax on CO2 emissions;

-

tax on the generation and temporary storage of radioactive waste.

What amounts of eco-tax are paid by domestic enterprises

Until 2022, public environmental registers maintained by the State Tax Service of Ukraine contained all information about who pays eco-taxes, how much they pay, and what they pay for. Every year, journalists and civil society activists used this data to create infographics with details broken down by region and revenue category.

After the start of the full-scale invasion, these registers are no longer publicly available. From time to time, officials from the tax service and its regional offices partially disclose the amounts of accumulated eco-taxes. We have collected the information available on official websites and presented it in several infographics. Although it is not complete, it gives an idea of the order of magnitude and trends.

The total amount of eco-tax collected in 2016–2025 (excluding data for 2022–2023, as it is not publicly available) is shown in the infographic below:

Key observations are as follows:

-

The minimum was in 2017.

-

Stabilization at the level of UAH 5.4–5.6 billion since 2021.

-

Overall growth of 19% during this period.

-

+3.7% in 2025 compared to the previous year.

As for the past year, the environmental tax indicators are as follows:

Below are the amounts of environmental tax revenues by region in 2025. Publicly available data cover 14 regions and the city of Kyiv.

* Data for January-November is shown for the Mykolaiv, Ternopil, and Kharkiv regions, for January-October for the Odesa region, and for January-August for the Rivne region.

Problems with the use of eco-tax in Ukraine

Discussions about the fact that eco-tax in Ukraine does not fulfill its main function and that approaches to this type of taxation need to be improved have been going on for over 10 years. There are three main reasons for discussion: who to collect it from, how to distribute it, and how to spend it.

A phantom fund

The State Environmental Protection Fund has a history of its own. It was established in 1991 with the adoption of the fundamental Law of Ukraine "On Environmental Protection."

For more than 20 years, the funds paid by enterprises for pollution had a specific purpose. They were accumulated in special accounts and could not be spent on pensions, roads, or teachers' salaries—only on environmental projects (construction of treatment facilities, forest protection, etc.).

At the end of 2014, the fund was effectively liquidated. As part of budget reform and due to a shortage of funds, lawmakers amended the Budget Code: most of the environmental tax was redirected from the special fund to the general fund of the state budget.

Legally, the name "State Fund for Environmental Protection" remained in the law, but in fact it ceased to exist as an autonomous "treasury." The money simply became part of the "common pot." This allowed the government to spend "environmental" money on patching up any budget holes.

Ukrainian-style Decarbonization

An attempt to partially correct the situation was the creation in 2024, within the state budget, of the budget program “Fund for Decarbonization and Energy Efficiency Transformation.” It is here that part of the collected CO2 emissions tax is now accumulated.

The responsible administrator of the program is the State Agency on Energy Efficiency and Energy Saving of Ukraine, which involved its subordinate JSC “Ukrainian Decarbonization Fund” in managing the funds.

The problem is that, contrary to its name, the Fund focuses on energy efficiency rather than decarbonization. Among the implemented and current projects of the Decarbonization Fund, the vast majority are as follows:

-

installation of solar power plants on state institution buildings;

-

energy certification and energy audits of government buildings;

-

procurement of gas meter devices;

-

financial leasing services for homeowner associations installing solar power plants on residential buildings;

-

improving building energy efficiency.

Recently, the Cabinet of Ministers of Ukraine allocated funds from the Decarbonization Fund for 10,000 portable charging stations for children with disabilities. This is a much-needed initiative, but what does it have to do with decarbonization?

Consider the irony: large enterprises, which are the main payers of the environmental tax, cannot use this financial resource for their own decarbonization projects. Instead, the main beneficiaries are communities and the public sector.

Why the System Doesn't Work

Officials, experts, and analysts point to a number of fundamental difficulties with environmental taxation in Ukraine and the related challenges.

1. Imperfect Design of Environmental Tax

The current Ukrainian taxation system is based on the actual volume of emissions of specific pollutants, whereas in EU countries the tax base is any physical unit that has a proven negative impact on the environment. The Ukrainian system is quite narrow and does not cover all significant pollution sources, in particular the transport sector, which generates up to 19% of total carbon emissions.

Following the European approach would require expanding the tax base and launching an emissions trading system in Ukraine.

2. Complex administration, information gaps, and ineffective control over standard compliance and tax payment

The Tax Code outlines the procedure for calculating the amount of the environmental tax based on data regarding emission volumes, but it does not provide a clear methodology for determining these volumes. As a result, enterprises often estimate emission volumes by eye or even deliberately underreport them to reduce their tax obligations. Consequently, budgets receive less funding.

Only specialists can verify whether an enterprise determines emission volumes correctly. Currently, they are physically unable to monitor all taxpayers, especially under conditions of full-scale war.

3. Lack of incentives for eco-modernization of enterprises

In many developed countries, environmental taxes are combined with incentive measures (tax reductions, grants, subsidies). In Ukraine, such instruments are absent.

4. Inefficient revenue allocation scheme

A significant portion of the funds (45%) is allocated to the general fund of the state budget without a designated purpose. These payments serve purely a fiscal function, rather than an environmental one.

Experts emphasize that such a system leads to dispersal of funds within the budget and the loss of the environmental function of the tax. Enterprises lose financial resources that could be directed toward decarbonizing production.

5. Inefficient use of funds at the local level

This issue deserves its own separate material under the title “How to Patch Budget Holes at the Expense of the Environment.” EcoPolitika regularly monitors what Ukrainian communities spend funds on that should have gone to environmental protection measures. Alongside examples of targeted use of environmental taxes, including:

-

installation of a wastewater treatment station in Bucha;

-

organization of a waste sorting facility in Ternopil region;

-

modernization of the heating system in a kindergarten in Khmelnytskyi, resulting in almost halved gas consumption

We frequently encounter a substitution of concepts, where environmental tax funds are directed toward housing and utility expenses instead of projects that genuinely improve the state of the environment. Communities often allocate the environmental tax to pseudo-environmental projects: tree trimming, street cleaning, or patching up sewer pipes under the guise of pollution prevention.

In Ivano-Frankivsk region, deputies used the war as a pretext for misallocating the environmental tax. By the end of 2024, they allocated 6 million UAH from these revenues to carry out programs for defense activities and mobilization preparation, as well as for the regional hospital for war veterans.

6. Symptomatic implementation of environmental taxation tools instead of thorough reform of the entire system

The state resorts to “cosmetic repairs” of the system through targeted rate increases or changes in reporting formats. This symptomatic treatment ignores the core problem: a narrow tax base and the absence of real financial incentives for industrial modernization. As a result, the tax remains merely a punitive instrument for general budget replenishment, rather than serving as a driver of ecological transformation, as required by EU standards.

Environmental tax in Ukraine requires comprehensive reform: from changes to the tax base and enhanced oversight to the creation of a transparent mechanism for allocation and use of funds, which would provide real financing for environmental measures and the “green” transition of Ukrainian industry, as mandated by potential EU membership.