After a three-year transition period, CBAM finally came into effect in the EU on January 1, 2026. The carbon border adjustment mechanism is essentially an additional duty on products whose production causes significant greenhouse gas emissions. Recently, a number of technical updates aimed at improving the accuracy of calculations and preparing declarants have been announced.

Final benchmarks and base values

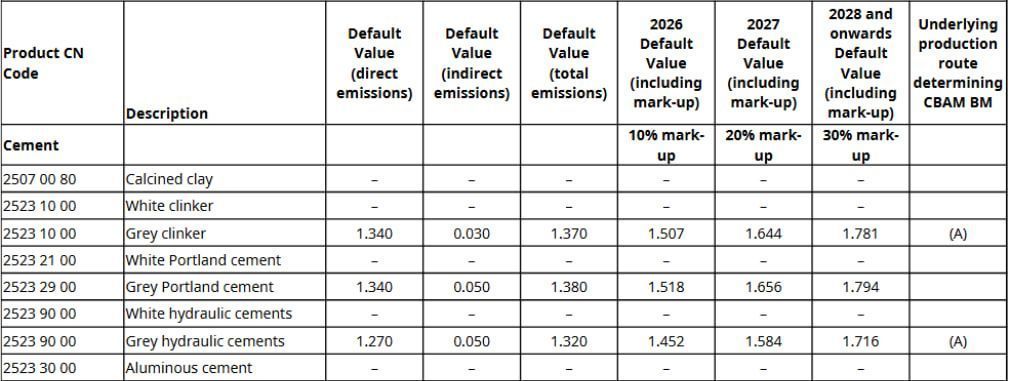

The European Commission has published the key indicators of the CBAM mechanism, which will now be final. In particular, these are default values and benchmarks for goods and products that cross the border.

The final baseline values for entities importing carbon-intensive products into the European Union — cement, fertilizers, aluminum, hydrogen, iron, and steel — have also been announced.

They differ for different countries, albeit insignificantly. For some types of products, an increase in default values is expected for the period 2026-2028.

Final default values for cement products from Ukraine. Source: taxation-customs.ec.europa.eu

Updated instructions and training materials

In its pursuit of transparency, the EU provides detailed guidance on how to apply CBAM, from authorization to reporting controls.

It has recently been reported that access to updated training materials is now open.

- A video block on the Authorisation Management Module (AMM). It consists of 20 materials covering an introduction to the platform, procedures for submitting and cancelling applications and permits, guarantee registration, and more.

- A video block on the Data Reconciliation and Monitoring Component (DRMC). This training, comprising three videos, introduces users to the component and the emissions declarant portal, including how to request and view information about goods and emissions, use quarterly and annual data aggregation, and more.

EcoPolitic previously reported that the European Union plans to expand the sectors to which the CBAM mechanism will apply.