The Verkhovna Rada of Ukraine has supported amendment No. 1061 to the draft state budget for 2026, which extends the preferential taxation of electric vehicles until 2027.

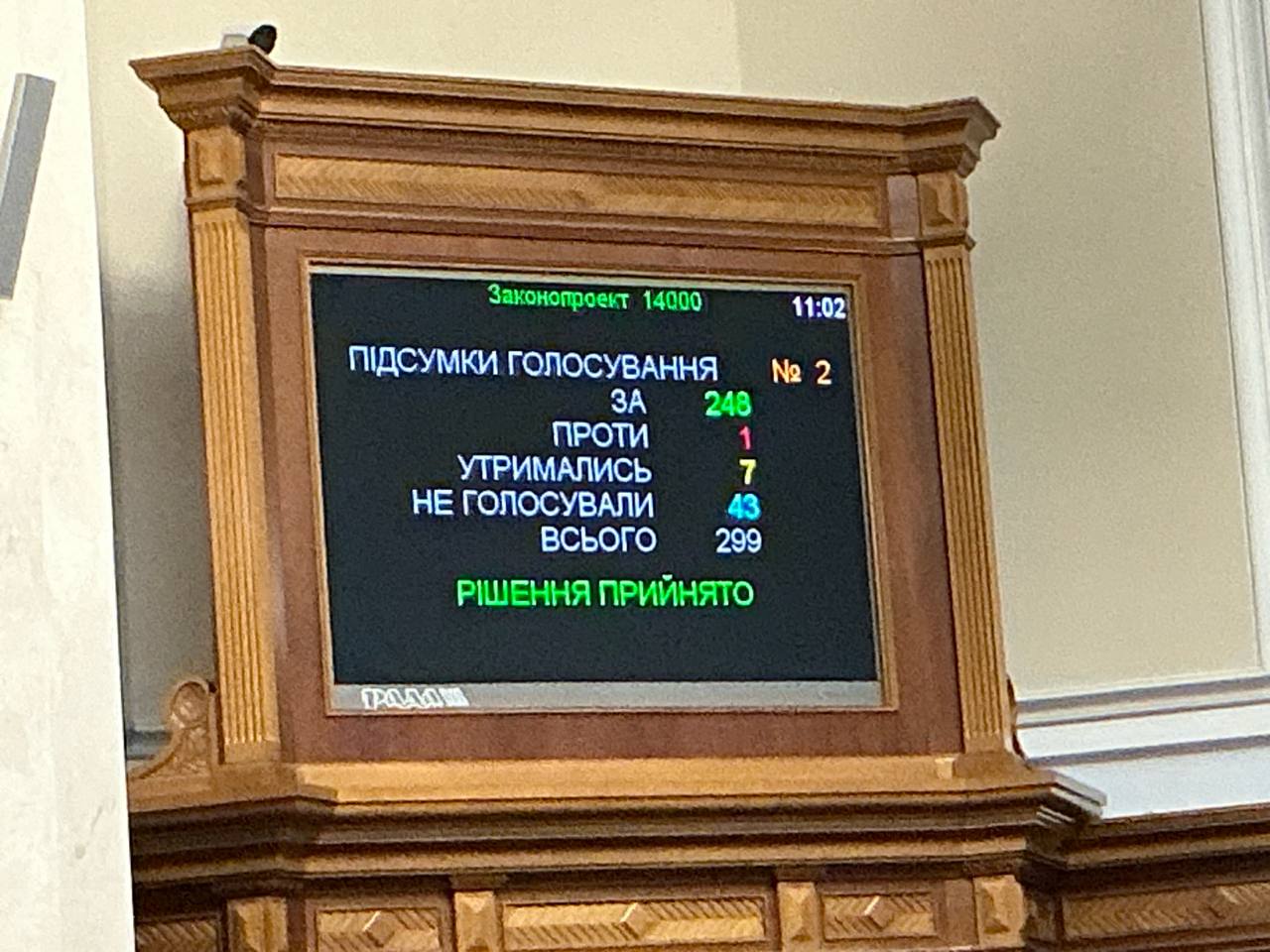

This became known at a meeting of the Verkhovna Rada on October 22, MP Yaroslav Zheleznyak reported on his Telegram channel. A total of 248 MPs voted in favor of extending the benefits.

Photo: yzheleznyak

The preferential regime provides for exemption from value added tax (VAT) and customs duties on imports of electric vehicles. The special taxation conditions were introduced to stimulate the development of the electric transport market, reduce harmful emissions and reduce dependence on fossil fuels.

The Verkhovna Rada has repeatedly extended the benefits for electric vehicles, in particular, to cover electric buses and components for the production of electric vehicles in Ukraine. According to industry associations, these tax incentives have helped to increase the number of electric vehicles in Ukraine several times, and the country has gradually formed one of the most progressive electric transport markets in Eastern Europe.

According to the Automotive Market Research Institute, as of September 2025, a record 12.1 thousand passenger electric vehicles were registered in Ukraine, which is 5.9% more than in August 2025 and 89.2% more than in September 2024.

Zheleznyak noted that the abolition of VAT and duties on electric vehicles is only a government order. That is, the amendment is not yet considered a final decision, as the Cabinet of Ministers is to submit the final text in November.

As a reminder, experts have released a list of 10 electric vehicles worth paying attention to in 2025.

The top five are:

1) Kia EV3;

2) Hyundai Ioniq 5 N;

3) Cupra Born;

4) Renault 5 EV;

5) Volkswagen ID.7.

In particular, in August, for the first time in the history of the Ukrainian car market, the share of electric vehicles accounted for approximately 50% of the total volume of passenger cars sold.