The energy multinational BP (formerly British Petroleum) has announced that it will increase investments in oil and gas while drastically reducing funding for various types of clean energy.

This was reported by The New York Times.

BP intends to increase investments in the oil and gas industry by 20% to about $10 billion a year, which will contribute to a potential moderate increase in production by 2030. At the same time, the company plans to reduce investments in renewable energy sources (RES) to $1.5-2 billion per year, which is about 70% less than its previous plans.

Why BP is cutting investments in renewables

In an interview, the company's CFO Kate Thomson said that these steps were the result of a reassessment of the conditions for energy companies.

According to the author of the article, Stanley Reed, this decision may be a response to the pressure from investors demanding higher returns and the realization that the energy transition to cleaner fuels is not happening as fast as previously expected.

The New York Times also reminded that 5 years ago, BP's previous CEO Bernard Looney announced major changes in the company, which included a plan to reduce oil and gas production by about 40% by 2030. Some analysts and investors applauded these targets at the time, as they were considered progressive for the industry.

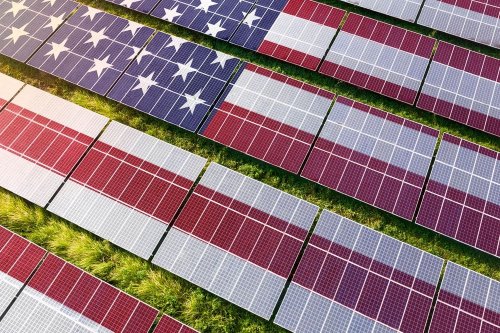

However, over time, oil and natural gas prices have risen. And some of the green energy industries in which BP invested, such as offshore wind power, have failed, especially in the United States.

Many companies and analysts note that the pace of the energy transition has slowed. Equinor, the Norwegian energy giant, recently announced plans to halve its investments in renewable energy.

Not all the company's investors are happy about it

In a recent letter to BP, a group of investment management firms questioned the shift to a greater emphasis on fossil fuel production.

The firms said that while they could understand the “short-term business case” for such a shift, in the long run it would increase the risk that the company could find itself “stranded or with assets that are declining in value as the energy transition progresses.”

The New York Times noted that BP's share price fell by 1.4% in London trading.

In early October 2024, EcoPolitic reported that the energy giant BP had changed its mind about cutting oil and gas production.