The published baseline benchmarks for the Carbon Border Adjustment Mechanism (CBAM) for 2026 turned out to be higher than most exporters had predicted.

This was reported by Pavan Yadav, a specialist at the carbon emissions analysis platform CleanCarbon.ai. He referred to preliminary figures published by Fastmarkets and several industry consulting companies.

The expert stressed that these figures are of great importance to steel and aluminum exporters to the EU, as they will directly affect their CBAM costs from January 2026.

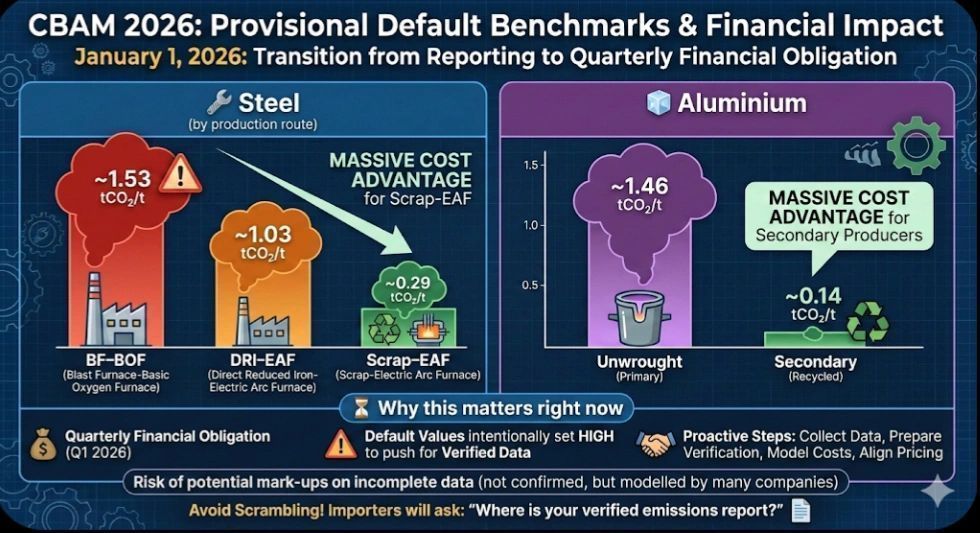

According to Pavan Yadav, the preliminary figures for steel (depending on the production method) are as follows:

- BF–BOF: ~1.53 t CO₂/t;

- DRI–EAF: ~1.03 t CO₂/t;

- Scrap–EAF: ~0.29 t CO₂/t.

The expert noted that the difference between production methods is significant.

“If you do not submit verified emissions data at the plant level, EU importers will be forced to use these default values, which means higher CBAM payments,” he warned.

For aluminum, the preliminary figures are as follows:

- unprocessed (primary): ~1.46 t CO₂/t;

- secondary: ~0.14 t CO₂/t.

Secondary producers have a significant advantage in terms of CBAM costs, the expert pointed out to exporters.

Why it matters right now

From January 1, 2026, CBAM will no longer be just reporting — it will become a quarterly financial obligation.

According to the expert, the default values are deliberately set at a higher level to encourage exporters to use verified data.

“There are also rumors in the industry about possible markups on default values if the data is incomplete. This has not yet been officially confirmed, but the risk is so real that many companies are already modeling worst-case scenarios,” said Pavan Yadav.

According to the expert, the exporters he works with who are ahead of the curve have already started:

- collecting Scope 1 and Scope 2 data;

- preparing verification workflows;

- making cost projections for 2026;

- agreeing on prices with EU buyers.

Recently, EcoPolitic reported that the European Commission had proposed a set of changes to the CBAM mechanism aimed at closing loopholes, preventing circumvention of the rules, and improving the effectiveness of the instrument.